Financial markets are trading very flat early on Friday as traders eagerly await the July jobs data from the US.

US Earnings the Key Component of Today’s Jobs Report

Traders are yet to buy into the Fed’s plans for another interest rate hike this year – December being the most likely date – which is hardly surprising given the data seen in the first half, particularly on the inflation front. With that in mind, while the unemployment number is likely to write the headlines and the jobs number will be the initial focus, earnings growth is key to today’s report, as well as those for the rest of the year.

Despite a number of metrics suggesting the slack in the US labour market has been significantly reduced, wage growth continues to elude the workforce, to the annoyance of the Federal Reserve. With higher wages being crucial to further progress both on the economy and its inflation target, the central bank will be hoping that the numbers start to improve, having actually softened since the start of the year.

EUR/USD – Euro in Holding Pattern Ahead of US Nonfarm Payrolls

Should we continue to see soft wage growth and inflation running well below target as a result, the Fed may be forced to delay plans on future rate hikes and instead focus on reducing its balance sheet. Given the clear desire to get interest rates closer to 3%, this is obviously a very undesirable situation, although it should be noted that the US is well ahead of others on this.

US Dollar Index Languishing at 15 Month Lows

The US dollar is continuing to languish at 15 month lows as a result of the belief that future rate increases will have to now be much slower, especially as Donald Trump has so far done little to boost the economy, as was expected. This is, of course, also a reflection of traders becoming more bullish on some of its peers as central banks elsewhere start to pivot towards a tightening position. Still the dollar index currently resides in a major support zone and a break below 92 could trigger much sharper losses.

Source – Thomson Reuters Eikon

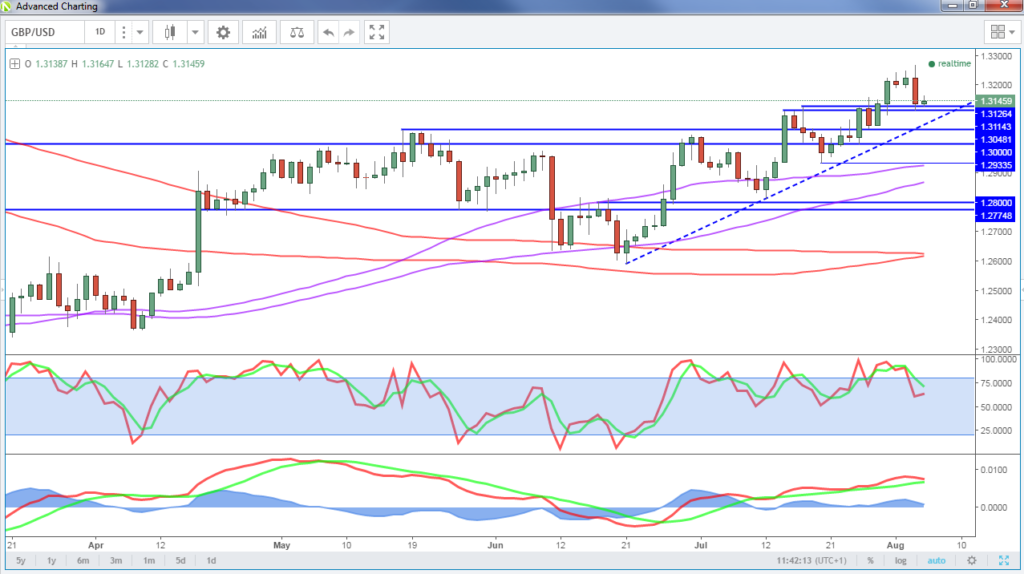

GBPUSD Recovering After BoE Induced Selling

Yesterday’s Bank of England meeting aided the greenback against the pound, with the pair falling back close to 1.31 as traders took the view that any rate increases are once again not a near-term concern. Even still, the pound continues to look bullish against the dollar for now, unless we see a break below 1.30, at which point we could see a dollar resurgence. This would make sense if we are going to see another strong rebound off the dollar index support zone.

OANDA fxTrade Advanced Charting Platform

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.