Consumer Revival Needed After Disappointing First Quarter

As cracks start to appear in the economic data, the Bank of England downgrades its growth and inflation forecasts and the country heads to the polls to vote for the government that will lead the Brexit negotiations with the EU, it’s clear that an interesting period lies ahead for the UK.

For almost a year now – since the EU referendum – we’ve heard a lot about the surprisingly resilience of the UK economy, while the BoE and other experts have been berated for their gloomy outlook for Brexit Britain. And while many of those will accept that the country has performed better than they anticipated, the cracks are starting to appear and the data so far this week has clearly highlighted where.

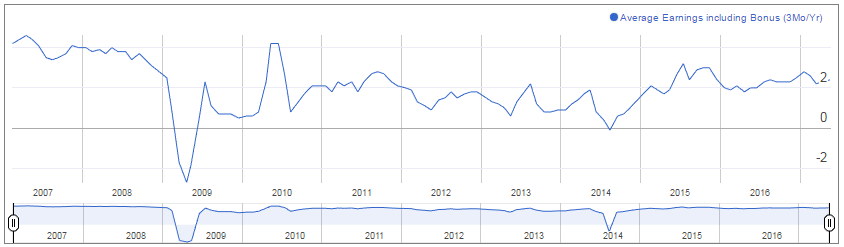

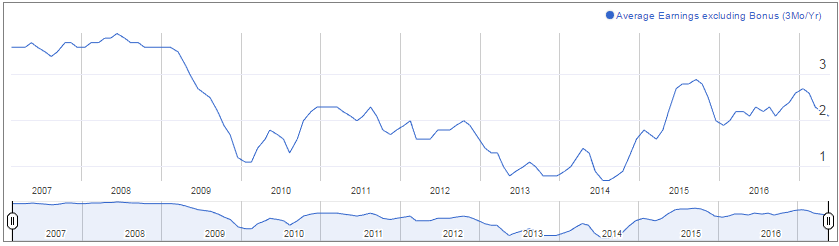

The retail sales report on Thursday should offer further insight into the consumer following a dire start to the year for spending and at a time when real incomes are now officially falling. The data released earlier in the week showed inflation hit 2.7% in April – albeit largely driven by the timing of Easter this year – while earnings rose by only 2.4%, or 2.1% excluding bonuses.

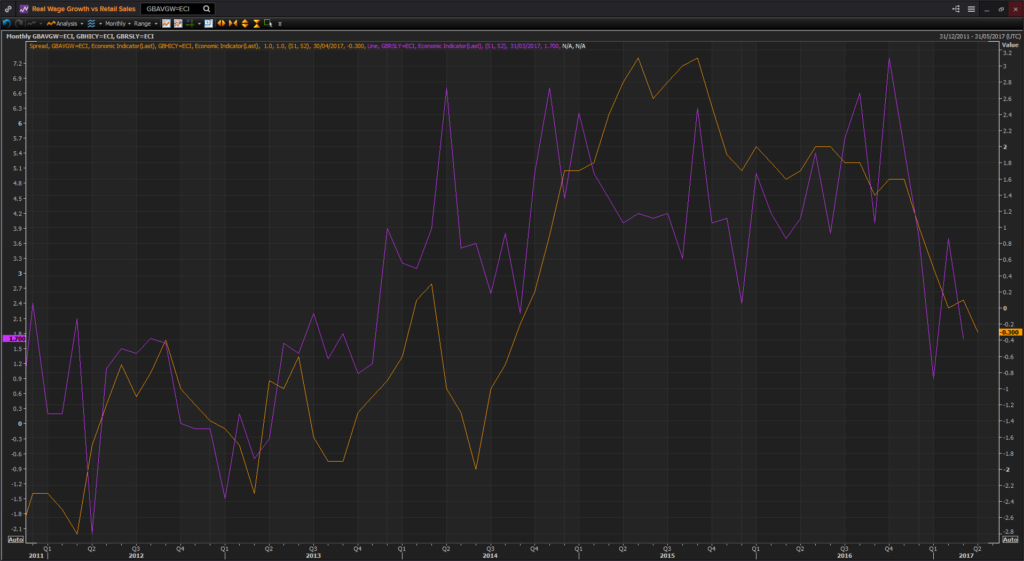

With at least the near-term outlook for real wage growth looking bleak – as the weaker pound keeps inflation elevated and the uncertainty surrounding Brexit weighs on wage growth – the coming months may be quite challenging for retailers. While the UK consumer is not particularly averse to spending on credit, which at times is what’s kept the economy ticking along, there is a clear correlation between real wage growth and spending and it doesn’t look good. The chart below shows real wage growth (earnings growth minus inflation) in orange and retail sales in purple, compared to a year ago.

Thomson Reuters Eikon Terminal

Given how valuable the consumer is to the UK economy and the trend over the last few months, it’s no wonder that the BoE downgraded its growth forecasts last week. Should we see a revival in the consumer in the coming months and the first quarter prove to be a blip, then the outlook could look a little brighter. Given the latest data on inflation and wages though, it’s not looking great.

A mini spending revival is expected for April, with overall and core retail sales seen rising 1% from a month earlier, and 2% and 2.5%, respectively, from the same month a year earlier. While this may give reason for some optimism, it is worth remembering again that Easter fell in April this year and March last year which will flatter the numbers in much the same way that it made them appear worse last month. We may need to see more evidence of a consumer revival if we’re truly going to see the resilience that we’ve heard so much about.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.