As the French once again head to the voting booths this Sunday to cast their vote in the second and final round of the French elections, investors appear to be in a cautiously optimistic mood despite there being the potential for chaos when the market reopens next week.

The first round of voting on 23 April saw two very different candidates progress to the second round to stake their claim for the Presidency, Emmanuel Macron and Marine Le Pen. The former – a centre ground pro-European who last year established his own party En Marche! (On the Move) – represents a more business friendly version of the status quo while the latter – a right wing eurosceptic who wants to pull France out of the eurozone – is generally viewed with fear by markets in a similar way that Brexit was. The reason for this is quite clear, Brexit was a very undesirable event for the European Union, Frexit could be the end of it, or so many people believe.

CAC Edges Higher as French Election Looms

Markets appear quite relaxed about the election, why is this?

I wouldn’t say they are relaxed but under the circumstances, they don’t appear particularly concerned about the vote and I think there is a number of reasons for this.

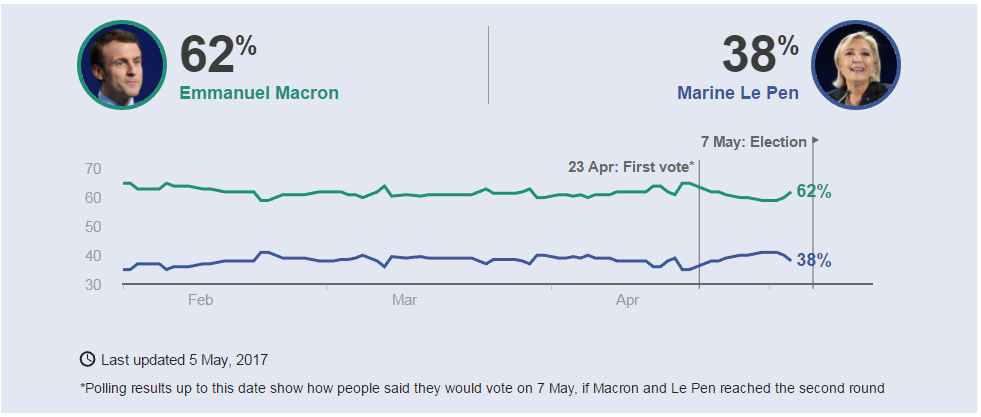

1. The polls

The polls haven’t been overly reliable in recent years – UK 2015 election, EU referendum, US Presidential election – which has led people to doubt the accuracy of them. Still, even with this larger than normal margin for error, Macron has had a 24 point lead over Le Pen for some time and should this be overturned, it would undoubtedly be the greatest shock of them all.

The polling average line looks at the five most recent national polls and takes the median value, ie, the value between the two figures that are higher and two figures that are lower.

Source – BBC

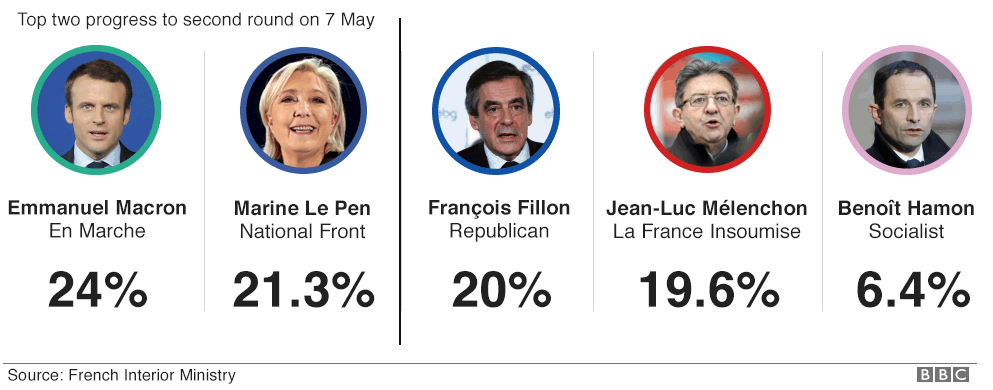

2. First round

For a long time, Le Pen was leading in the polls and even then, Macron was seen as the runaway favourite in the second round. As election day neared, her lead slipped and Macron crept into the lead before taking 24.01% of the vote to Le Pen’s 21.3%. If the majority of those who voted for the fallen candidates were already expected to vote Macron or abstain, this result doesn’t bode well for Le Pen.

Source – BBC

3. TV Debate

This was seen as Marine Le Pen’s time to shine, an opportunity to capitalise on her political experience, expose Macron’s weaknesses and appeal to the roughly 17% of still undecided voters. Success here may have closed the gap and given Le Pen some momentum in the final days leading up to the vote. Instead, polls conducted after the event suggested it was the inexperienced Macron that stole the show and by a relatively large margin, not too dissimilar to that which the polls suggest we’ll see on Sunday.

4. Referendum

Unlike the EU referendum in the UK, a Le Pen victory would take France closer to the exit door but not yet through it. Le Pen has vowed to hold a referendum on its membership of the eurozone and it’s far from clear that the country would vote to leave.

Macron has Euro Markets on Firm Footing

What can we expect on Sunday?

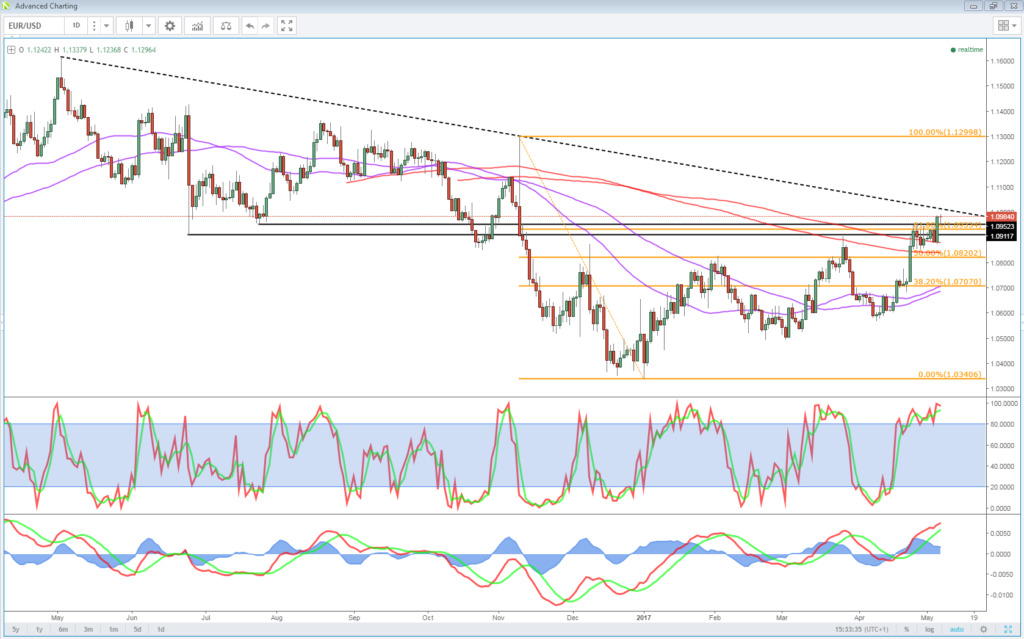

Scenario 1: Macron Victory

As I stated earlier, investors appear cautiously optimistic about this outcome and as a result, I don’t believe there is much risk premium being priced into the markets. That in itself shouldn’t be taken as a sign of voting intentions though, as we learned on 23 June last year (Brexit). The euro is trading at a six month high against the dollar, the CAC (French index) at its highest in more than nine years and the spread between French and German 10-year yields (a barometer of French risk) is back within the range it traded in prior to the spike in November.

Source – OANDA fxTrade Advanced Charting Platform

Source – Thomson Reuters Eikon

What this does mean is that there appears little room for a significant and sustainable bounce. That may not stop markets engaging in a relief rally at the start of the week – it doesn’t guarantee it either – but I don’t believe we’ll see anything like the kind of moves that would come in the alternative scenario.

Scenario 2: Le Pen Victory

The run up to the French election remains me of the days before the UK voted on its membership of the EU with one difference, this time there is good reason to be a little confident (albeit never complacent), the gap in the polls is huge. While people were confident (and wrong) that the UK would vote to remain, the polls were only showing a slim margin, that is not the case here. Most polls give Macron a 24 point lead which will be extraordinarily difficult to overcome.

Should it happen though, the reaction in the market could be very reminiscent to that which followed the UK vote, albeit possibly a little less extreme due to point 4 above (a referendum). Still, with little risk premium being priced in, I would expect some major moves on the open next week and some extreme risk aversion with the flight to safety likely benefiting the traditional safe havens such as Gold and the yen. The euro could suffer quite badly while French yields would likely spike – given how they traded when Le Pen was leading in the polls – and the CAC may take a considerable hit.

It would also be interesting to see how this outcome would also affect sterling, the FTSE and Gilts. Would Le Pen be beneficial for the UK in Brexit negotiations? Would this prove to be a distraction for the EU and a far greater priority meaning negotiations with the UK take a back seat?

French Election Timeline

May 5 – [from midnight] Poll blackout

May 7 – Second round of French presidential elections. Last polls close at 19:00 BST / 14:00 EDT, with an exit poll result announced immediately.

May 11 – Official proclamation of the new President.

May 14 – [from midnight] End of Francois Hollande’s mandate

June 11 – First round of legislative elections

June 18 – Second round of legislative elections.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.