Financial markets have moved into risk averse mode as traders appear to lose faith in Donald Trump’s ability to deliver on his ambitious election pledges.

The Trump trade has seen equity markets soar to record highs since November, with investors willing to look beyond some of the more unsavoury aspects of his mandate and instead focus on his growth agenda. However it’s now coming to the end of the first quarter and people are starting to question just how long these measures are going to take and whether they’ll get through Congress without compromises having to be made along the way.

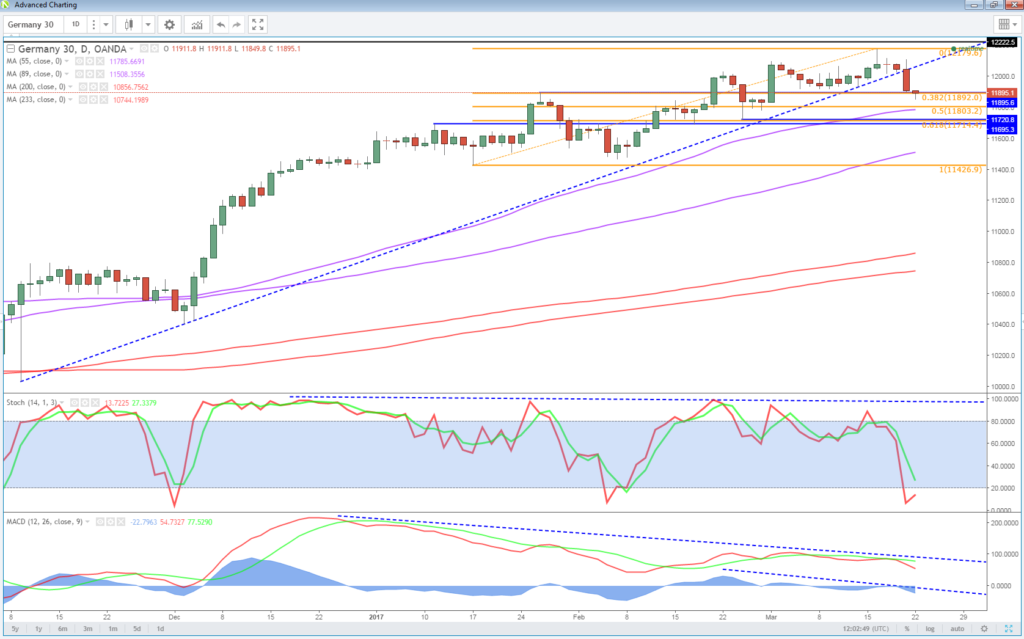

DAX Slides on Concerns over Fed’s Rate Projection

The difficulties facing Trump over the healthcare bill, something that should have been relatively straightforward for him to get support on given the Republicans staunch opposition to Obamacare, is casting serious doubt over his other policies. A failure to get this through could jeopardise his plans for tax cuts and large infrastructure projects, the very things that investors have strongly bought into since the election.

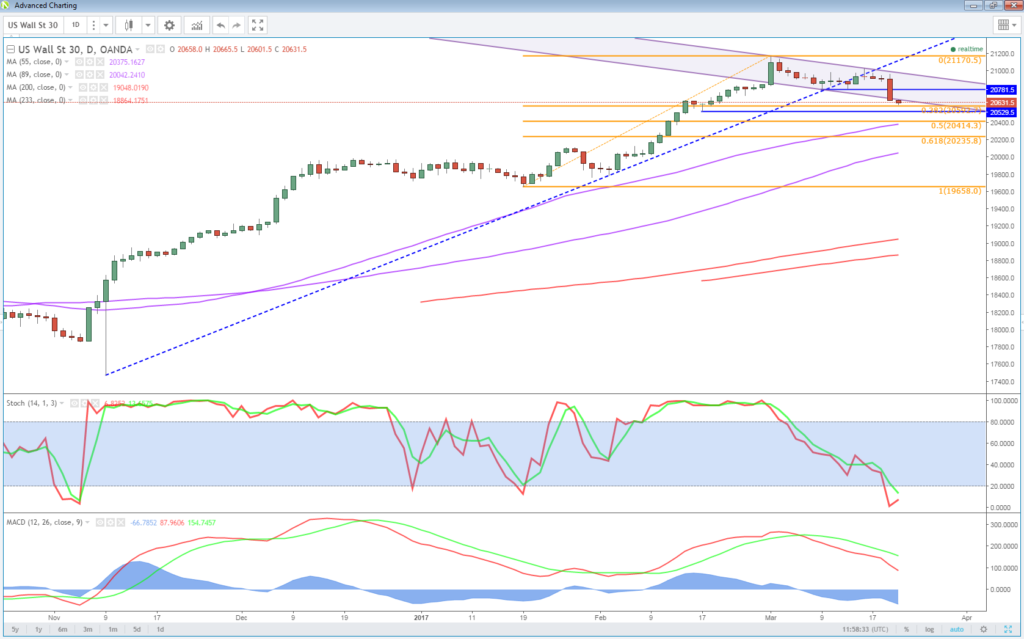

It seems that the blind faith that investors had in Trump to deliver is starting to fade and the positions are being unwound and if yesterday is anything to go by, we could be in for a sharp correction. None of this is to say that Trump wont eventually follow through on his pledges and if he does, markets will likely reverse course once again. But indices could only go so high before serious questions were going to be asked and if would appear we’ve now hit that point and the answers simply aren’t good enough.

OANDA fxTrade Advanced Charting Platform

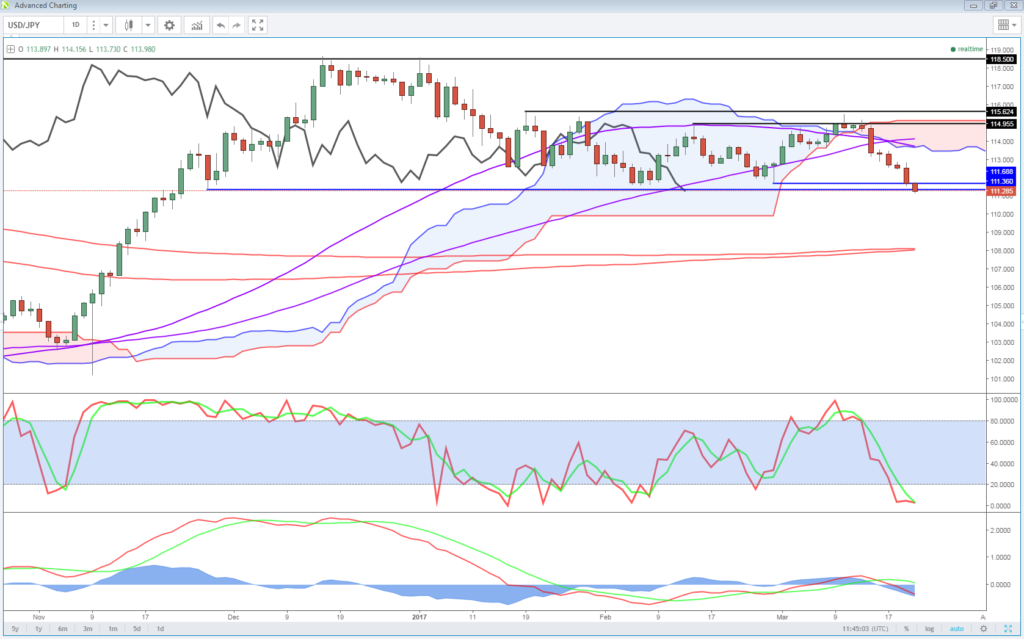

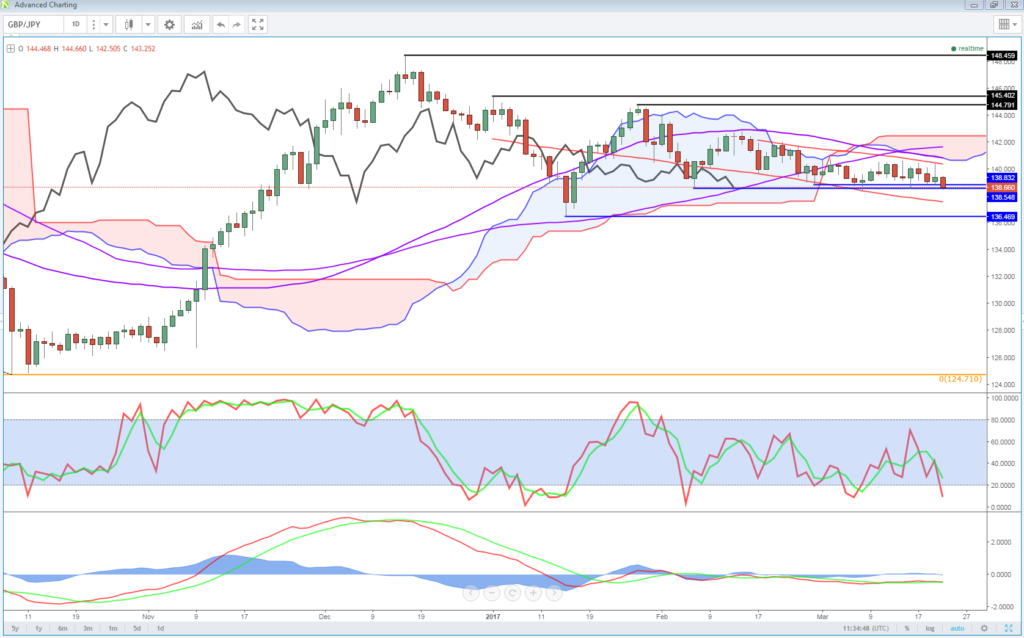

The moves of the last 24 hours are some of the largest we’ve seen since the election and aside from going in the wrong direction, they’ve also taken out some technical supports which could further exacerbate the move. The safe havens are currently benefiting from this sudden risk aversion in the markets with Gold making small gains, having already rebounded strongly over the last week on the back of profit taking in the dollar, while the yen is also performing well, taking out technical support against the dollar and strongly testing it against the pound.

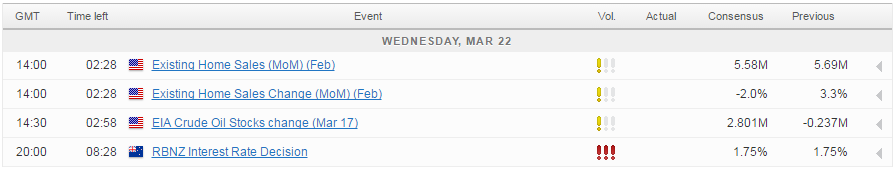

With not much to come on the economic data side today, apart from existing home sales, and Fed officials taking a day off from public appearances, the unwinding of the Trump trade may remain the key theme today. We will also get some oil inventory data from EIA, which could add to the woes in Brent and WTI crude, with the former looking to test the psychologically significant $50 mark and trade at levels last seen at the end of November.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.