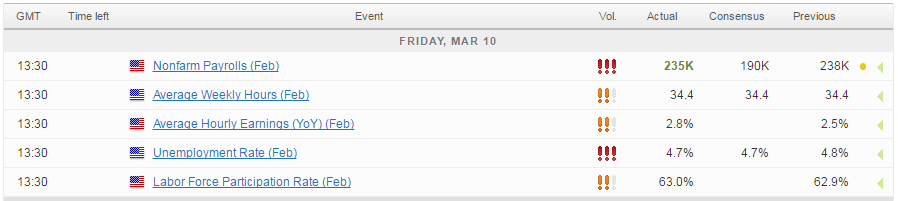

It may not have been the knockout NFP that the ADP release on Wednesday indicated it could be, but today’s US jobs report was more than adequate to justify a rate hike next week, assuming of course that the markets have correctly interpreted the Fed’s very deliberate hawkish delivery over the last few weeks.

It’s difficult to find anything to be down about in the jobs report, with job creation being well above the 12 month average and far exceeding what the Fed deems to be good enough. Unemployment fell even as participation rose to 63% – only the second time it’s reached that level since April 2014 – while average hourly earnings rose to 2.8% year on year, not quite good enough yet but heading in the right direction.

USD/CAD – Canadian Dollar in Holding Pattern Ahead of Canadian, US Job Reports

All things considered, if the Fed was keen to raise interest rates next week, as it indicated it is, then today’s report will only have aided the decision. The dollar may well have weakened following the release but this is probably due to the NFP number falling short of the ADP reading which raised people’s expectations. The only thing standing in the way of a rate hike now is the Fed itself but after its efforts over the last few weeks, surely even it won’t bottle it now.

OANDA fxTrade Advanced Charting Platform

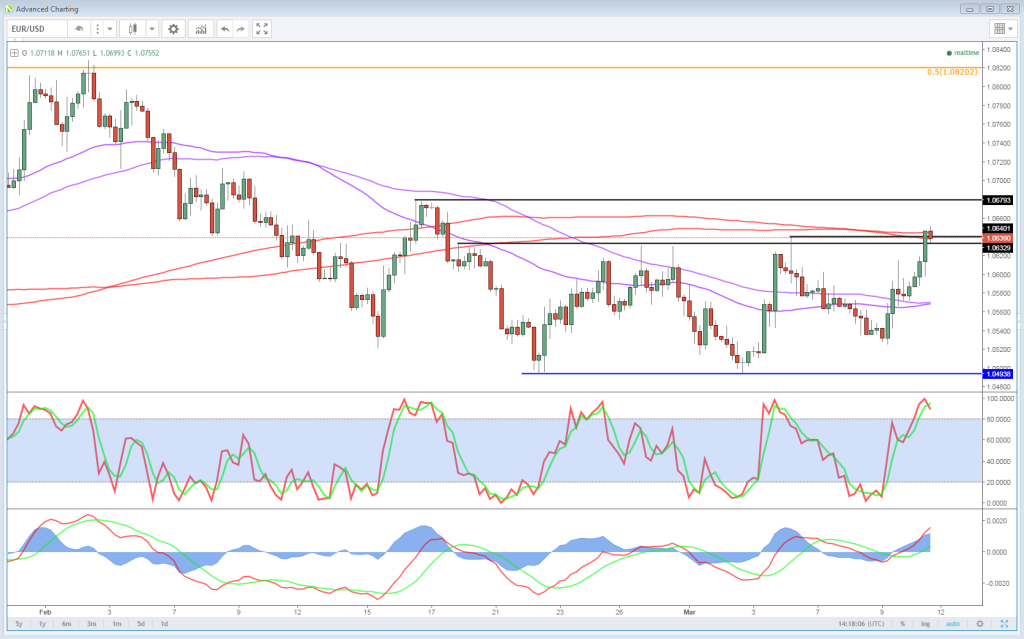

The drop off in the US dollar has triggered some interesting moves, for example in EURUSD, where the pair has broken above the range it has been contained within for almost three weeks. As of yet, the breakout has not triggered a substantial move to the upside, which could be expected if a large number of stops had been triggered. Perhaps this suggests we’re seeing a false breakout and the pair will once again settle back inside the range. Alternatively, another move above today’s highs could break down what’s left of the resistance, with the next notable level coming around 1.0680.

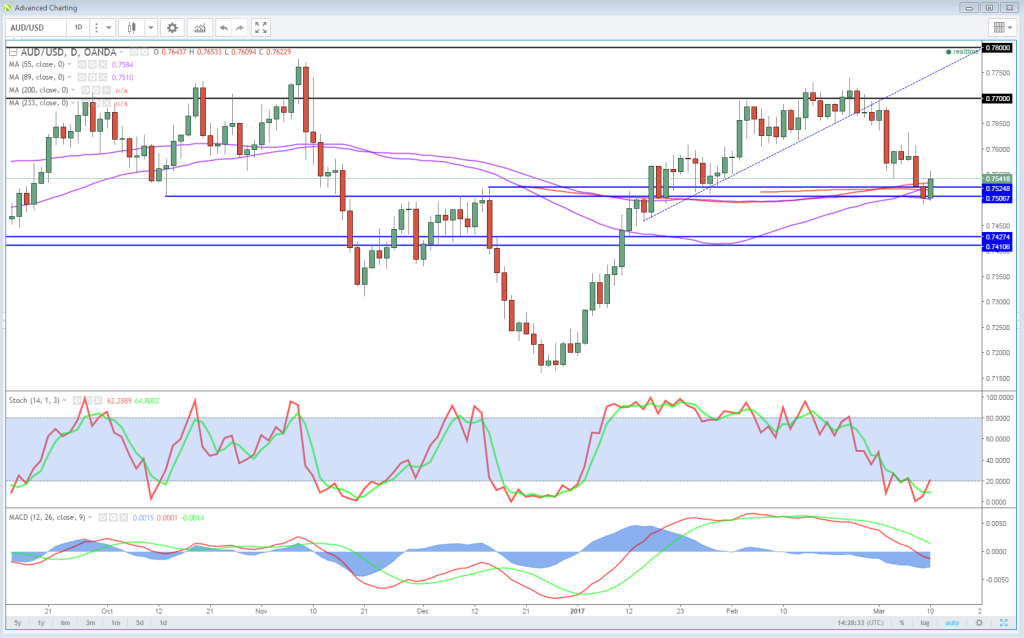

The commodity currencies have been particularly battered as of late, with dollar strength and its impact, among others, on dollar-denominated commodities delivering a double blow to them. The AUDUSD is getting some relief following the jobs data, just as a very important support, around 0.75 was coming under significant pressure. With 0.7550 currently proving to be a strong resistance level to the upside – prior support – the relief may not last very long but as long as the pair doesn’t break above 0.7633 – this week’s high – then 0.75 may not be out of the woods quite yet.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.