A day after the Dow extended its winning streak to 12 straight session – the longest in 30 years – US futures look a little flat ahead of the open with all eyes firmly on Donald Trump’s first appearance before Congress this evening.

The sustainability of this rally in the near term may well rest on how Trump performs this evening and whether promises of big spending and phenomenal tax reforms are accompanied by any insight into what they will entail. Trump’s words, while lacking few if any actual details, have so far been effective in getting investors pumped up at the prospect of a stronger economy but the longer this goes on, the less effective these promises are going to become and higher the risk is that the rally will run out of steam.

DAX – Steady Ahead of Trump Congress Address

The last few sessions may have seen the Dow extend its winning streak but the gains we’re talking about have been tiny. The market may well already be experiencing Trump fatigue and he’s now put himself in a position where he must deliver, and in a big way, or markets could quite quickly turn against him. I think Trump fully intends to deliver on the substantial promises and therefore in the longer term, these levels may be justified. The risk is that he’s unable to do so as quickly as he hoped at which point doubt will set in and I think markets may be preparing for the prospect of that a little in recent days.

OANDA fxTrade Advanced Charting Platform

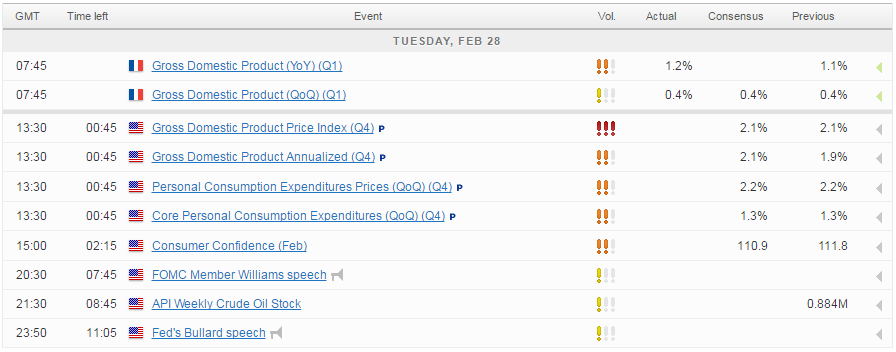

While Trump’s appearance today is the clear stand out event, there are a number of others that could have an impact on the markets prior to this. Three Fed policy makers are due to appear throughout the day, only one of which though – Patrick Harker – is a voting member on the FOMC this year. The other two – John Williams and James Bullard – will both be voters over the next couple of years and will of course have insight and a voice in the discussions. Most policy makers have broadly stuck to the same line over the last couple of months, that a hike sooner rather than later will be appropriate, while offering little insight on when exactly that would be referring to. Market pricing would suggest that means May or June although the latter would make three hikes this year – as per the Fed’s own forecasts – very difficult.

Watching USD/JPY for the Dollar’s Next Move

There’s also a lot of economic data due today, including the second release of US fourth quarter GDP, which is expected to be revised up slightly from 1.9% to 2.1%. We’ll also get CB consumer confidence data as well as some other lower level releases. Later this evening, API will report its inventory figures for last week, the last few of which have been fairly consistent with the EIA number, released on Wednesday.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.