A very dovish RBNZ slapped down the rate hikers today. Sending NZD down 1% with some interesting set-ups on the crosses as well.

The RBNZ announced it’s OCR today, leaving it unchanged at 1.75% and saying that any tightening might be at least two years away. The unchanged OCR was expected, what wasn’t, was the extremely dovish tone of the Central Bank afterwards. Post New Zealand’s stellar inflation expectations earlier this week, many in the market had started pricing hiking sooner than later, building 35 basis points into the curve by the end of 2017.

The Governor and Deputy Governor certainly did their best to take the wind out of that particular train of thought. The level of the NZD and the NZD TWI are clearly much bigger priorities for them at this stage, and they do not want to nip the emerging inflation bud too soon. (they have made this mistake before btw)

Looking at a selection of the headlines below,

RBNZ GOVERNOR SAYS IF HOUSE PRICE INFLATION STARTED TO PICK UP AGAIN, LINKED TO STRONG MIGRATION FLOWS, THEN WOULD “CERTAINLY BE LOOKING AT MACROPRUDENTIAL INTERVENTION” – source Reuters

AUD/NZD

AUD has been the perennial bridesmaid against the NZD lately. From a trading point of view there is a lot more bad news priced into the AUD at the moment then there is the NZD, leaving the later exposed. From a personal point of view, over the years, it has always been a dangerous business in history selling AUD/NZD at or near 1.0300. History is littered with traders who have started talking parity and done just that. Myself included.

AUD/NZD has taken out its 55, 100 and 200-day moving averages in the space of 24 hours and should be respected technically.

Minor resistance is just above here at 1.0610 with a multi-day series of tops in the 1.0660 region. Support now is at 1.0535 the 200 DMA and 1.0520 the 100 DMA.

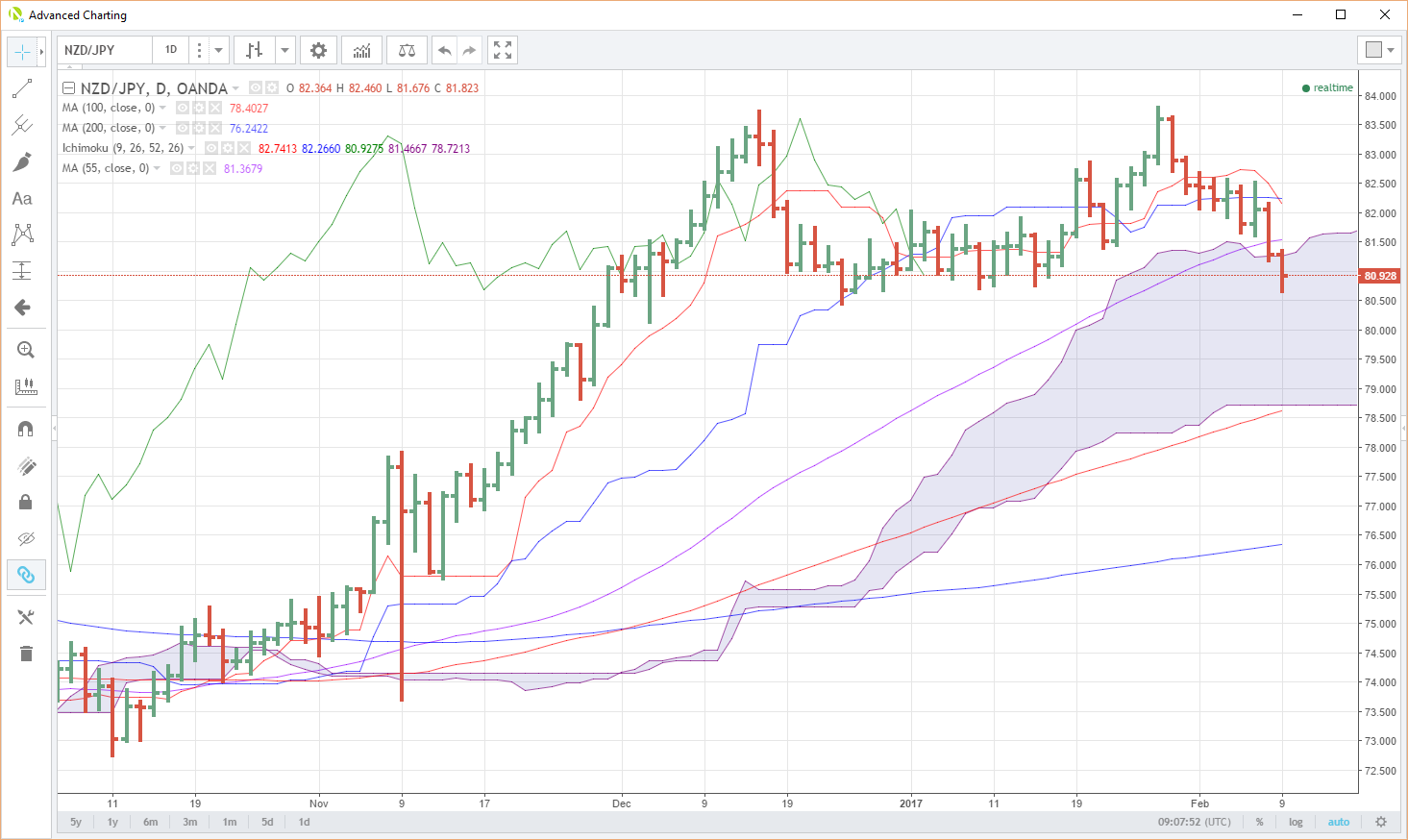

NZD/JPY

Has been on a downtrend for the last week or so. Today it broke the 55 DMA at 81.55 and the top of the Ichi-moko Cloud at 81.30. These now become resistance.

A break of 80.65 (multiple previous daily closes) signals a possible technical move to the base of the cloud and the 100 DMA at 78.60/78.75 area. A daily close inside the cloud should be respected by traders from a technical perspective.

From a longer-term point of view, the cross now has a very well defined double top at 83.80.

XAU/NZD

A more esoteric pair for sure, but an intriguing chart after today’s NZDUSD move. Clearly, Gold has been bid against just about everything as perceived turmoil in the world sends safe haven flows its way.

Today’s session, though, has taken out the 100 DMA at 1710, potentially setting up a move to the 200 DMA at 1176.15. I note on this chart that whenever this cross appears to break the 100 DMA in recent times, it tends to move on to the 200 DMA.

Another interesting point is that the top of the daily Ichi-moko was also broken today at 1715 (near the 100 DMA). Superimposing this on the chart below makes it look too “busy” for my liking but traders are free to do so on their systems. What is particularly interesting to me is that XAU/NZD has not been above the top of the cloud since August 2016.

Summary

The RBNZ has sent New Zealand Dollar currency and interest rate hawks to the naughty spot in no uncertain terms. It remains to be seen whether they are allowed back to have their dinner or not so to speak. The price action, however, on NZD has not been constructive today. 24 hours is a long time these days in the markets. A consolidation of the Kiwi’s losses over the next few days could signal a much deeper correction is on the cards.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.