US equity markets are poised to open a little higher on Wednesday as we await a selection of economic data and the first FOMC monetary policy decision since Donald Trump’s inauguration.

Trump and his aides have made efforts in recent days to talk down the greenback which has to an extent been successful, with the dollar index having slipped back below 100 to its lowest level since the December meeting. This comes alongside markets also pricing in only two hikes this year – rather than the three that the Fed has outlined – with the next coming in June.

USD/JPY – US Dollar Higher Ahead of Fed Announcement

In the absence of a press conference with Chair Janet Yellen following today’s announcement, investors will be left to pour over the statement that it released alongside the decision to see whether views have changed on the path of interest rates this year since the last meeting. Given that the Fed is none-the-wiser when it comes to Trump’s spending and tax plans, I would imagine the views of policy makers will be unchanged since the middle of December and they will reiterate an intention to hike three times.

With the dollar more than 4% off its post-hike highs, it could start to look attractive once again to traders as long as the Fed sticks the same script.

Source – Thomson Reuters Eikon Platform

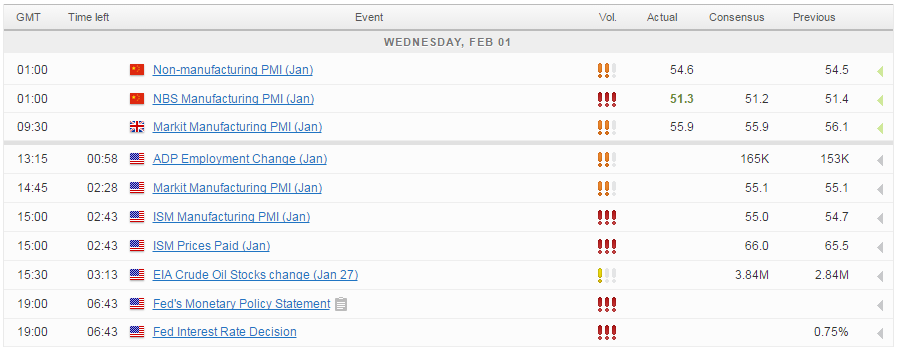

Of course, this will also be dependent on what we get from Trump today, given his ability to both excite investors and worry them on a regular basis. We’ll also get some economic data from the US throughout the day including ADP non-farm employment data and manufacturing PMIs. This will be accompanied by crude inventory numbers from EIA, with another small build expected.

Dollar Licks Its Wounds in Currency War

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.