With the festive period now upon us, markets are likely to enter a slightly quieter period, particularly as the final major risk events of the year have passed without any real problems.

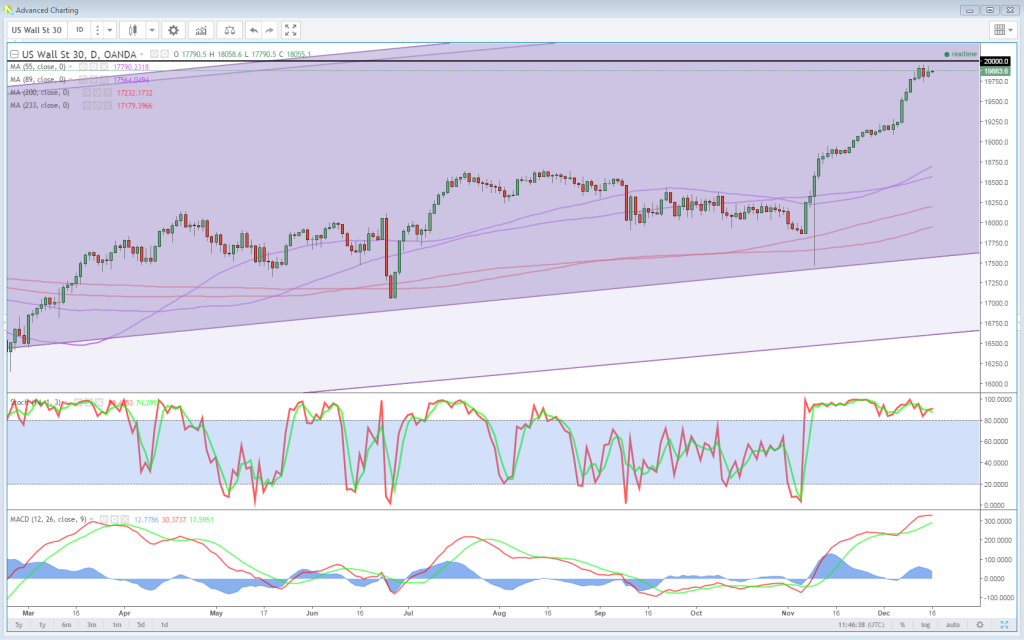

Futures currently suggest we’re going to see a similar open on Wall Street today as that seen in Europe, where markets are currently floating in and out of positive territory. The santa rally that has propelled the Dow to within touching distance of the psychologically important 20,000 level appears to have lost some of its sparkle as we near the end of the week, but with triple witching upon us, there may yet be one more surprise in store.

Halfway Point for December Holiday Volatility

OANDA fxTrade Advanced Charting Platform

The Fed rate hike and above market expectations for further increases next year has done little to deter investors despite prompting a little profit taking on Wednesday. Given the strength of the economy and potential for higher levels of economic growth in the coming years, it would appear rate hikes are no longer met with fear and panic, at least for now.

The Italian banking sector remains a big risk in Europe and reports that the Italian government is stepping up efforts to recapitalise the ailing banks with a €15 billion fund is doing little to ease investor concern. Given the regions new rules on bail ins it’s perhaps unsurprising that investors are not getting carried away with these reports, with a number of hurdles potentially still lying ahead.

Kiwi Roosts Nervously on Daily Support

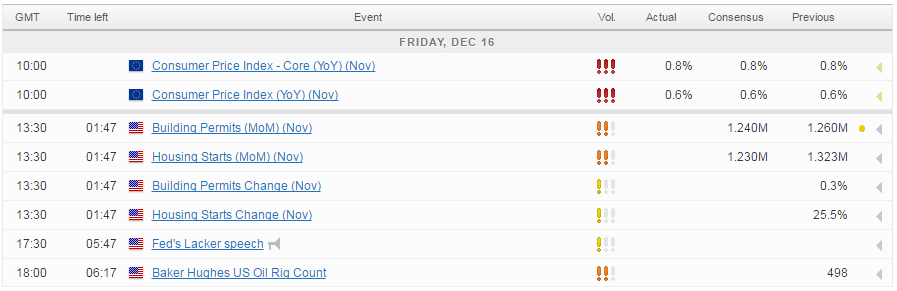

As far as today is concerned, it’s looking a little quiet on the economic data side, with building permits and housing starts the only notable releases coming from the US. We’ll also get the latest rig count data from Baker Hughes. Last week’s 21 rig increase took the total number of rigs agonisingly close to 500, which is the highest since January when the numbers were dwindling and fast. It seems these new higher oil prices combined with significant productivity improvements and consolidation in the industry is sparking a resurgence that will likely be matched by rising output in 2017, just as other producers agree to cut by almost 1.8 million barrels per day.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.