US futures are pointing higher on Monday, on course for similar gains to what we’re seeing in Europe where indices are threatening to or have broken above recent trading highs, in what could be a bullish sign for equity markets.

As it stands I remain sceptical about the sustainability of the recent rally in equity markets, with the fundamentals not exactly supportive of a prolonged bull run and the charts of S&P 500, Dow and FTSE 100 in particular looking toppy. It could be a very interesting week for equity markets, especially with so many companies reporting third quarter earnings which will undoubtedly be a major catalyst.

Dollar Bulls Await Fed Speakers Support Today

It’s also worth noting that next week brings monetary policy decisions of four major central banks – the Federal Reserve, Bank of England, Bank of Japan and Reserve Bank of Australia – which could influence trade this week. While the Fed is widely expected to hold next month, less than a week before the US heads to the polls, the announcement and statement that follows may well offer strong clues ahead of the December meeting which could shape how markets trade in the weeks ahead.

As far as today is concerned, its central bankers that will dominate in the absence of any notable economic data. Speeches from James Bullard and Charles Evans will be of particular interest, with the former being a voting member of the FOMC this year and one of those that did not dissent at the last meeting, and the latter being a voting member in 2017. We could also hear from Jerome Powell and William Dudley – two permanent voters – who are due to meet with members of the SEC and the Treasury.

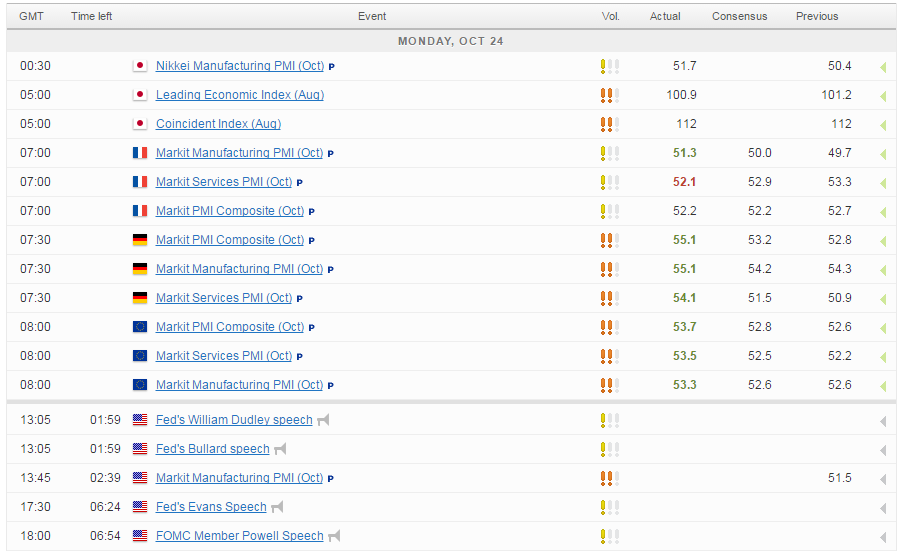

While today is looking a little light on the data front, following the release of some encouraging PMI readings from the euro area this morning, the rest of the week has plenty on offer which could offer plenty of catalysts for the markets.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.