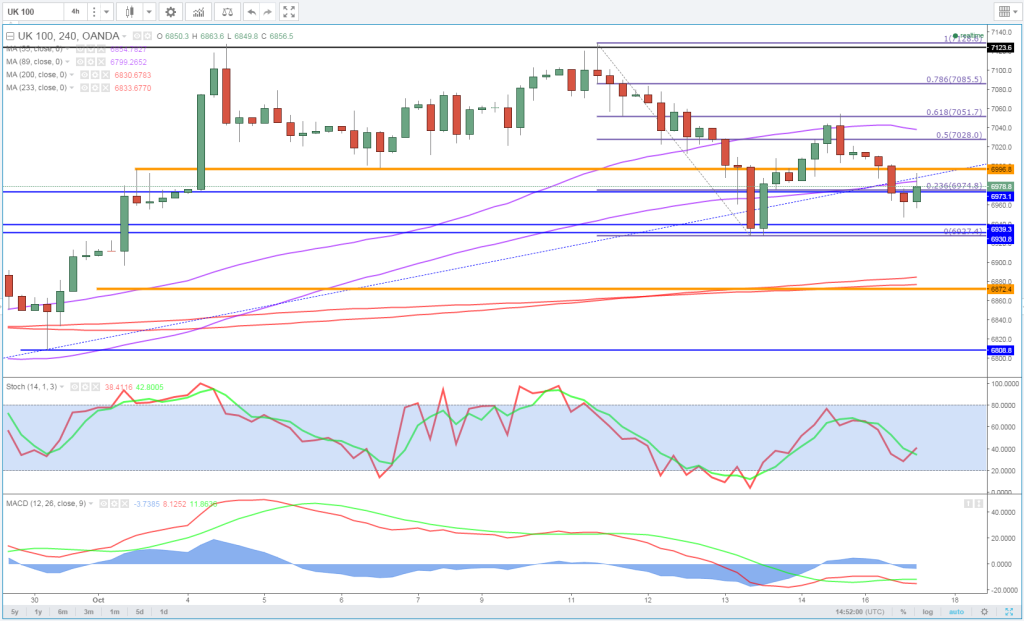

The UK 100 has started showing some weakness over the last week or so after failing to make a significant new high for a second time in the space of a week.

Since then, the ascending trend line – 24 June lows – has come under some pressure, firstly on Thursday when a late recovery ensured is closed the day above the line, then again today.

OANDA fxTrade Advanced Charting Platform

As far as today is concerned, we have once again seen a bounce from the early lows but I’m not convinced that the index is bottoming out for a couple of reasons.

OANDA MP – Indices Continue to Struggle (Video)

The first is how the UK sold late into the close on Friday, which possibly suggests that traders that bought the dip didn’t have the confidence to hold it over the weekend. This kind of behaviour is not exactly consistent with confidence in the ability to break to new highs.

The second is that following the two failures to make new highs, a double top was formed and the neckline broken. While we did trade back above the neckline on Friday, it never took out the double top highs and so in my view, it remains in play.

Based on the size of the double top, we could still see a move back towards 6,875 which would mean the index has made lower highs and lower lows and the trend line has been broken.

At this point, it could find support from the 55-day simple moving average but further losses may well follow. The next notable support level could then be found around 6,775-6,800 followed by 6,650 and 6,615.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.