Tuesday is likely to be one of the quieter days in an otherwise busy and important week for the markets, with investors having one eye on Friday’s US jobs report following Janet Yellen’s hawkish comments at Jackson Hole on Friday.

Not only did Yellen give an upbeat assessment of the US economy on Friday, this was backed up by comments from her vice Chair Stanley Fischer who claimed that Yellen’s comments were consistent with as many as two rate hikes this year. We’ve had this hawkish commentary from officials on numerous occasions in the past but with a consensus appearing to build and policy makers repeatedly hinting that at least one hike this year is likely, markets need to take notice.

Still, investors are not totally convinced which makes Friday’s jobs report extremely important. Should we get a strong jobs report for August then the next FOMC decision in three weeks will absolutely be a live meeting, whether markets want to accept that or not. A weak report probably leaves us back at square one from where the markets are positioned because even now, they’re reluctant to buy what the Fed is selling.

While this is likely to be one of the quieter sessions on the economic data side, there are some releases that will be of interest. UK consumer credit numbers will be released shortly after the open which will give some useful insight into demand and availability of credit in July, the month after Brexit. Given what the other consumer data has told us since the vote, I don’t think we’ll see a dramatic change in the numbers and any change at all will probably be put down to it being a knee jerk reaction, unless it’s followed by a couple more months to support it.

XAU/USD – Gold Subdued as US Consumer Numbers Meet Expectations

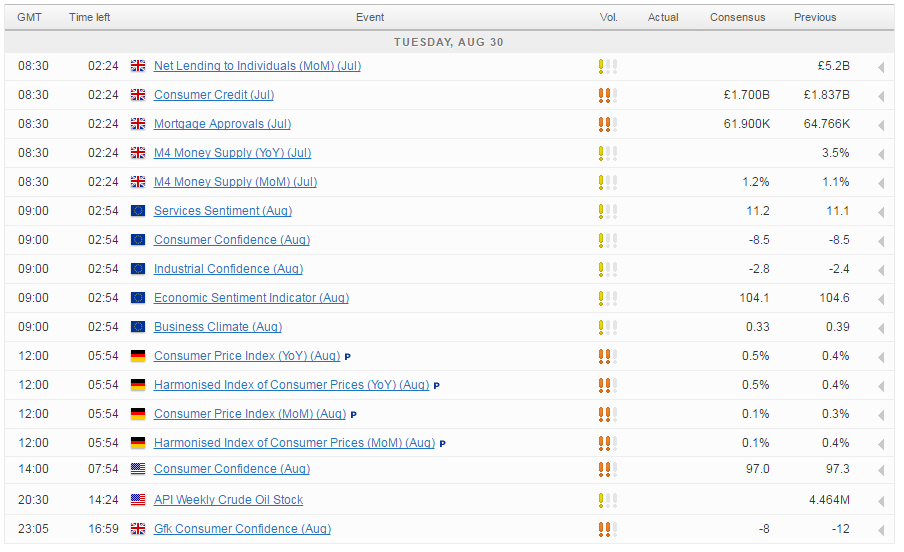

In the eurozone we’ll get some services, industrial, consumer, business and economic sentiment surveys for August. While these tend to get less traction as they follow the PMI data, they are still useful and provide additional insight into how the economy could perform in the final four months of the year. We’ll also get some inflation data from Germany ahead of tomorrow’s preliminary eurozone reading for August.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.