The trend of marginal moves while pushing record highs in US indices looks set to continue on Wednesday, with futures pointing to a marginally higher open on Wall Street.

This week in particular there has been a keen focus on the Jackson Hole Symposium, at which Federal Reserve Chair Janet Yellen is scheduled to speak. This, along with the seasonally quiet trade, may explain why we haven’t yet seen any explosive moves in the US this week. Jackson Hole has on numerous occasions in the past been used to hint heavily at upcoming policy moves and with a rate hike possibly being on the horizon, the question is whether Yellen will utilise this platform once again.

While the message coming from Fed officials has been quite mixed and left the markets with little idea of what the Fed is planning –it initially intended to raise rates four times this year and so far it hasn’t done so once – the message from Stanley Fischer and William Dudley, both permanent voters on the FOMC, last week were quite hawkish. Should Yellen deliver an equally hawkish warning on Friday then I expect markets to respond accordingly, with December likely becoming the most likely meeting but September being more priced in that it currently is.

AUD/USD – Aussie Shrugs Off Weak Construction Report

Equally, should she keep the cards close to her chest as she has opted to in the past, markets may take this as a sign that she is still far from convinced and could push back rate expectations even further. Given the situation we find ourselves in, it’s perhaps not entirely surprising that we’re seeing this cautious approach this week, particularly in such illiquid summer markets.

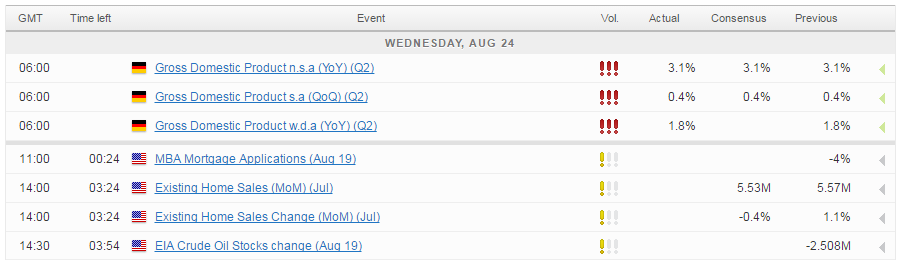

That said, there is some economic data being released throughout the session today that will be of interest. The nine year high in US new home sales in July, as reported yesterday, appeared to be very good news for the housing market at a time when unemployment continues to fall and mortgage rates remain very low. While existing home sales aren’t performing quite as well, we are seeing numbers around the highest levels we’ve seen since 2010 and another stellar number today would only add to the optimism surrounding the housing market and the state of the economy as a whole.

We’ll also get the latest EIA crude oil inventory data, which comes as WTI and Brent are coming off their two month highs. Last week brought an end to three consecutive weekly increases in inventories and it will be interesting to see whether we see another today. Markets are currently expecting a small drawdown but if yesterday’s API number is anything to go by, they could once again be well off. A strong build could be enough to push WTI crude back towards $45 a barrel, where it could find some support.

Source – OANDA fxTrade Platform

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.