The USDJPY, Yen crosses, and the NIKKEI under relentless pressure today as position squaring and possible disappointments take their toll.

The hype over Japan stimuli seems to be fading fast into Friday’s BoJ meeting. Various officials have been out on the wires this morning and overnight and the general tone seems to be one of less is more rather than a big bang.

This continued to weigh on USD/JPY and JPY/Crosses in the Asia session. Following on from my thoughts Friday, USD/JPY fell out of bed this morning as pre-central bank meeting liquidity deteriorates. USD/JPY broke the New York lows at 105.75 and dropped 100 pips in quick succession, to 104.75, triggering stop losses and more pain on the Yen crosses.

The headline below seems to have been the nail in the coffin of a nervous market,

10:30 (JP) Japan PM Abe: To maintain FY20 fiscal target – Govt sees FY20 nominal GDP at ¥583T assuming economic growth- Will not reach nominal GDP target of ¥600T in FY24 if economic growth maintains current pace. – Source TradeTheNews.com

The Government’s central fiscal 2020 target is to achieve a budget surplus under the grand Abenomics plan. The parlous state of government finances does erode their ability to come out with a “king hit” stimulus package. With the FOMC unlikely to come to the rescue with a rate hike, the cold realisation we may be in for disappointment sees short JPY positioning taken off the board before the Bank of Japan meeting.

The NIKKEI is also suffering down 1.44% as we speak.

USD/JPY

Daily support at 104.45 broken as I write with nothing until 103.17, previous double top and Ichimoko conversion line. Resistance way above now around 105.75, the New York lows.

YEN CROSSES

GBP/JPY

Leading the way down 200 points on the session. GBP/JPY was already wobbling overnight following a Guardian newspaper story warning a major high street bank was preparing to introduce negative interest rates on business accounts.

GBP/JPY daily support at 137.30 has broken, and a daily close under here opens 133.60 on the charts. Daily resistance at 139.00 seems a very long way away right now.

EUR/JPY

Did not pass go at all overnight. Closing on the New York low around 116.25 and heading straight down into Asia as a soft EUR weighs in combination. Daily support lies at 113.60.

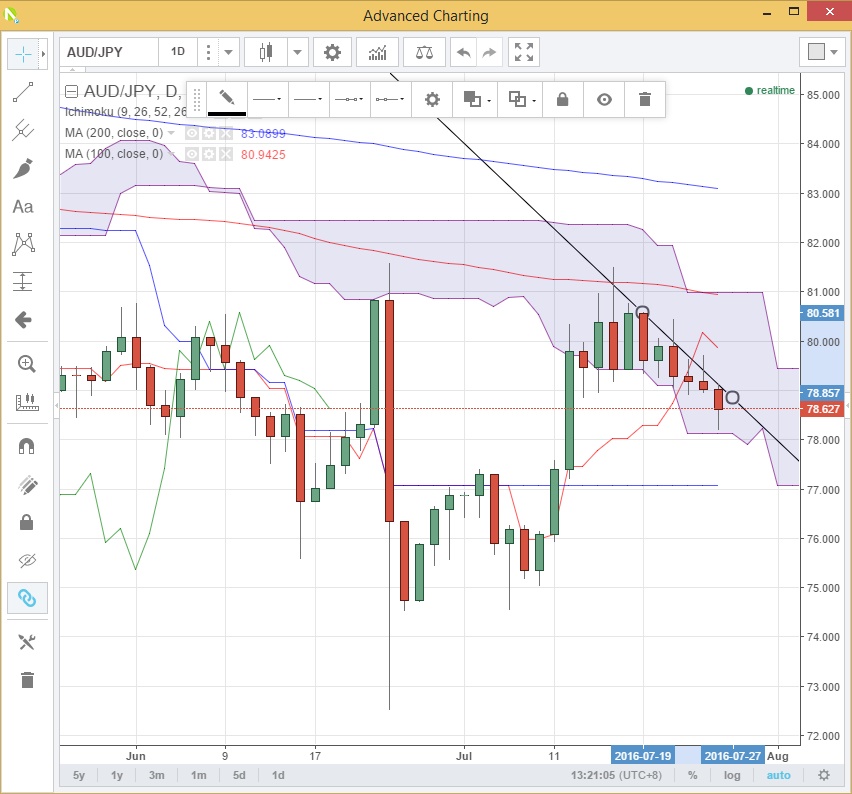

AUD/JPY

Remains “in the clouds” so to speak. In this case the daily Ichi moko cloud. Resistance comes in around the trendline at 79.00 and then 79.40.

Support at 78.14, bottom of the cloud and then 77.40.

XAUJPY

Another double whammy with XAUUSD softer as general USD strength continues. From the highs of 141750 a week ago we are trading at 137650 presently. The 100-day moving average sits below at 137150 with the top of the daily cloud at 135750.

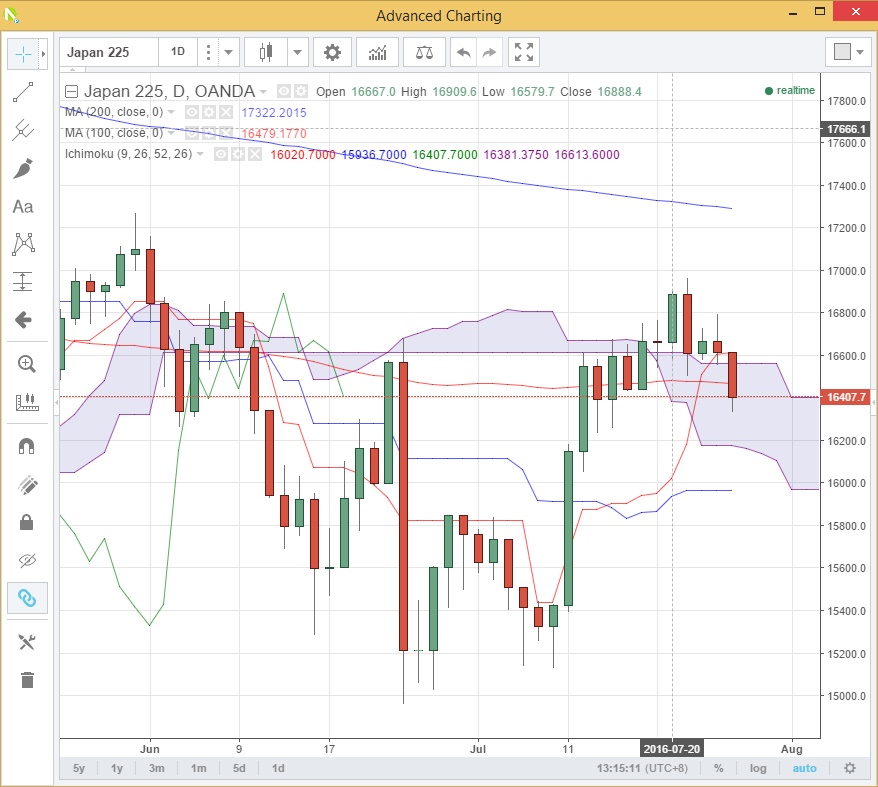

NIKKEI

Finally turning to the Nikkei. More headlines adding to the general negative sentiment leaves the Nikkei hovering at daily support having fallen into the Ichi moko cloud and broken the 100-day moving average at 16470 already this session.

12:21 (JP) Japan Fin Min Aso: Govt yet to decide on size of stimulus spending; Still considering appropriate amount – financial press – Source TradeTheNews.com

Support is right here at 16385, previous daily lows and then 16175 cloud base. The 100 DMA at 16470, top of cloud at 16560 and former triple bottom around 16600 leave a lot of wood to chop topside.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.