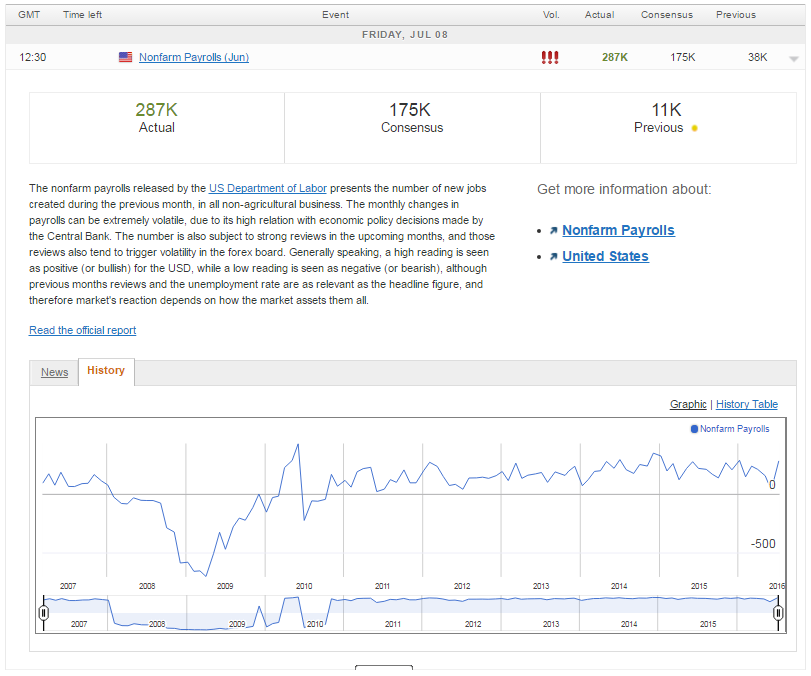

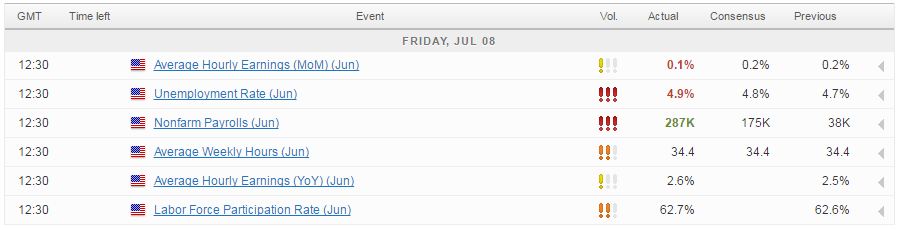

The U.S. labour market bounced back in June following the disappointment in May, creating 287,000 jobs which was well ahead of market expectations. As always with the jobs report, there is much more to it than the headline numbers would suggest, including the fact that the previous two NFP numbers were both revised, May’s down to a shocking 11,000 and April’s up to 144,000.

Source – Economic Calendar

The important thing to consider here is that across the three months, the average number of jobs created was just over 147,000 which based on the communication from the Fed in recent months is good enough at these levels of unemployment.

Unemployment rose from 4.7% to 4.9% which is not as bad as it looks given that this was partly due to an increase in the participation rate and is still down from 5% in April. The biggest concern in the report is the continued lack of wage growth pressure, something that has been absent throughout the recovery and shows little sign of improving despite the amount of slack in the labour market having fallen considerably. As long as this remains absent, the Fed has a good reason to keep interest rates at these very low levels.

While we saw a spike in the dollar following the data, with EURUSD dropping back to 1.10 immediately after the release, and a corresponding sell-off in Gold, this data is unlikely to change the near-term outlook for Fed interest rates. While I wouldn’t write off a hike at the end of the year, assuming the jobs data between now and then is very good and wage growth shows signs of improvement, the risks posed by Brexit in the near-term are likely to deter the Fed from tightening and unnecessarily causing further problems for both the economy and financial markets.

Update – Since the release, both the dollar and Gold have rebounded and now trade close to pre-release levels. Possibly a sign that expectations are relatively unchanged after the June jobs numbers.

Source – OANDA fxTrade Platform

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.