U.S. futures are pointing to a higher open on Thursday, while indices in Europe are trading more than 2% higher in what appears to be a sign of confidence that the U.K. is going to vote to remain in the E.U..

Ahead of such a huge vote, it would not have been surprising to see investors in a cautious or risk averse mood, given the levels of volatility we can possibly expect in the next 24 hours. Even the pound, which is possibly the best barometer of sentiment ahead of the referendum result, is soaring this morning, having touched its highest levels since the turn of the year.

The polls released this morning showed support for remain gathering speed once again, stealing the momentum back from the leave campaign which last week looked like it was swaying the public at just the right time. Not only are the polls pointing to a victory for remain, the betting odds which have previously been a far better barometer of the eventual voting, are now strongly in favour of remain, with an implied probability of above 80%.

Given how the markets have tracked betting odds in the run up to the vote, it should perhaps not be too much of a surprise that we’re seeing risk appetite remain strong today. Although I would possibly have expected to see investors a little more conservative given that the vote is far from guaranteed. There remains a large number of undecided voters and while these may be more likely to vote for the devil they know, I think the markets may well be writing off the possibility that they don’t a little too much.

The result of this is that, in the event of a vote to leave, the consequences in the market could be quite severe. The pound is now up around nine cents against the dollar from a week ago on the belief that the U.K. will vote to remain. A vote to leave would surely wipe all of that out quite quickly and further losses would likely follow. We’d also likely see the markets go into risk-off mode under these circumstances which would offer strong support for safe haven assets including gold. The upside in the event of a win though no longer looks that great. In fact, while we could see an initial spike higher in the pound, I wouldn’t expect it to hold on to much of these gains for very long. The markets are clearly already pricing in a high probability of a vote to remain.

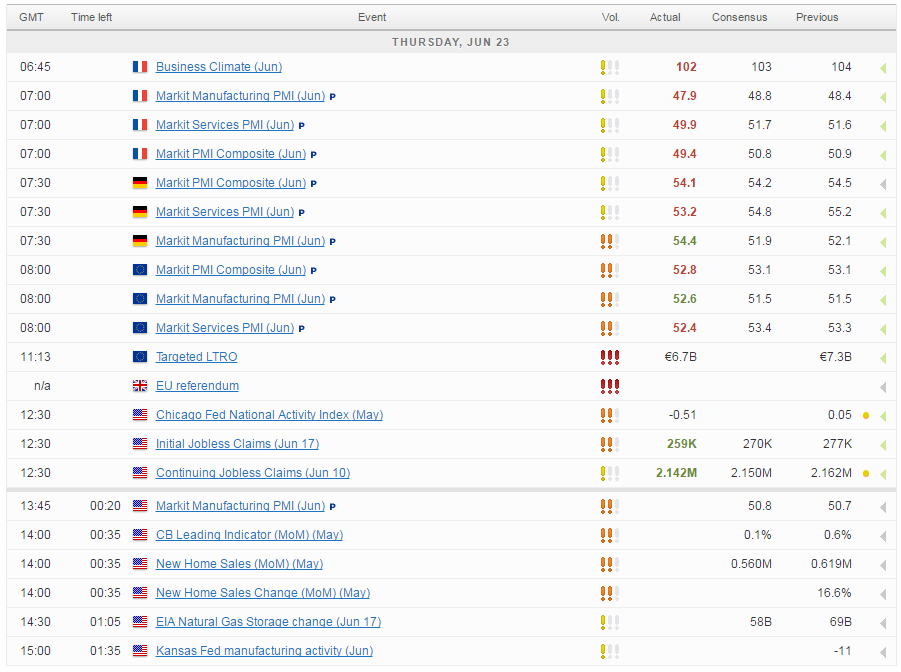

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.