European equity markets are on course to open relatively flat on Tuesday as investors continue to monitor the latest developments around the U.K. referendum and U.S. interest rates.

These continue to be the big risk events for the markets and are therefore likely to continue to have the greatest impact. We’ve had a couple more Brexit polls overnight and both point to a very narrow one point lead for the “Remain” campaign. With momentum, though, very much with the “Leave” campaign, it would appear, at least from the recent polls, that there is a very real chance that the U.K. could vote out, which could play havoc with the markets, particularly the pound.

The two polls overnight have lent support to the pound early in today’s session, although the spike from around 1.4480 to 1.4640 shortly after 5am in the U.K. has been attributed to a fat finger trade. Still, the pound is currently trading around 1.45 against the dollar, up around 0.5% on the day, reversing the majority of Monday’s losses. With the polls pointing to a very tight race, the next couple of weeks could become increasingly volatile for the pound.

Fed Chair Janet Yellen’s comments on Monday left the door open to two interest rate hikes this year, despite an overwhelming belief in the markets – based on the implied odds from Fed Funds futures – that this is not going to happen. Yellen steered clear from suggesting that the next one could come in June which may well be the final nail in the coffin for that, but she state that the positive forces supporting employment growth and higher inflation will continue to outweigh the negative ones. This kind of hawkish language would suggest that July remains very much on the table although the Fed once again has a job on its hands convincing the markets.

The Reserve Bank of Australia left interest rates on hold overnight, which came as no surprise given that they only cut them to record lows at the last meeting. The Aussie dollar has spiked higher following the decision to trade at fresh one month highs against the greenback. Still, many people still expect another rate cut this year, despite the fact that growth does appear to be picking up again in recent quarters.

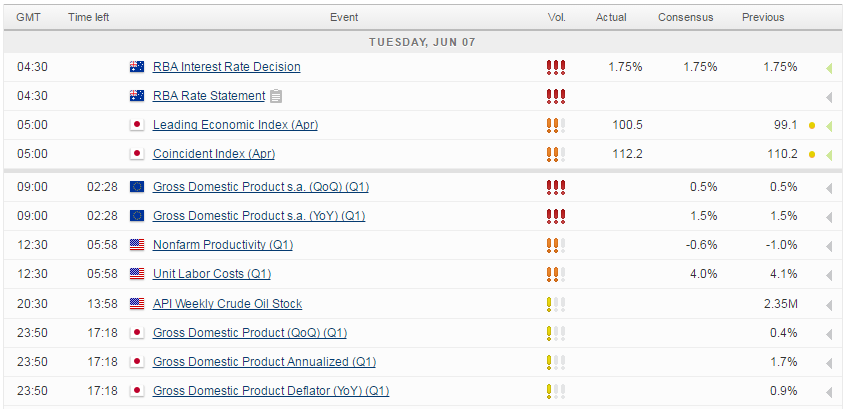

It’s going to be another relatively quiet day for key economic data, although there are some notable releases throughout the day. The revised first quarter GDP figure for the euro area will be released early in the session and is expected to confirm growth of 0.5%. This will be followed this afternoon by revised unit labour costs and non-farm productivity figures from the U.S..

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.