It’s been some time coming but it seems the markets are finally waking up to the idea that the Fed could raise interest rates before the end of the year, even more than once.

There has been repeated warnings from various Fed officials recently which have been largely brushed off by an investing community that was certain that the tightening process has been put on hold, at the very least until December. This has clearly been taken on board by the Fed with the rhetoric from officials becoming increasingly hawkish and firm, the markets are wrong and rates could rise multiple times this year, rather than the “possibly once” that is currently priced in.

The latest comments came from John Williams, Dennis Lockhart and Robert Kaplan, none of whom have a vote on the FOMC this year, but the fact that all were very much on message has clearly resonated with investors, who have now become more open to the idea of a rate hike earlier in the year. The fact that these are all typically among the more centrist officials is perhaps what has made people sit up and pay attention. If these are insisting that rates will rise, perhaps it represents a consensus within the Fed to continue tightening regardless of the external risks and apparent weaknesses in the domestic economy.

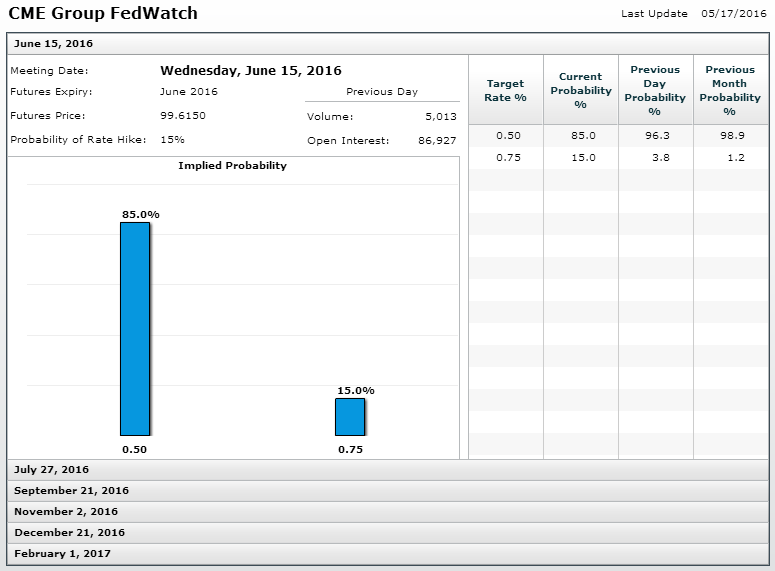

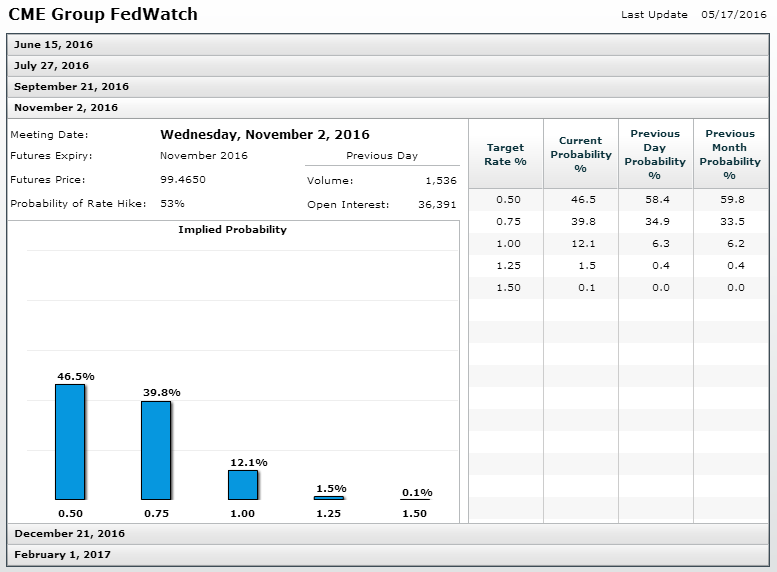

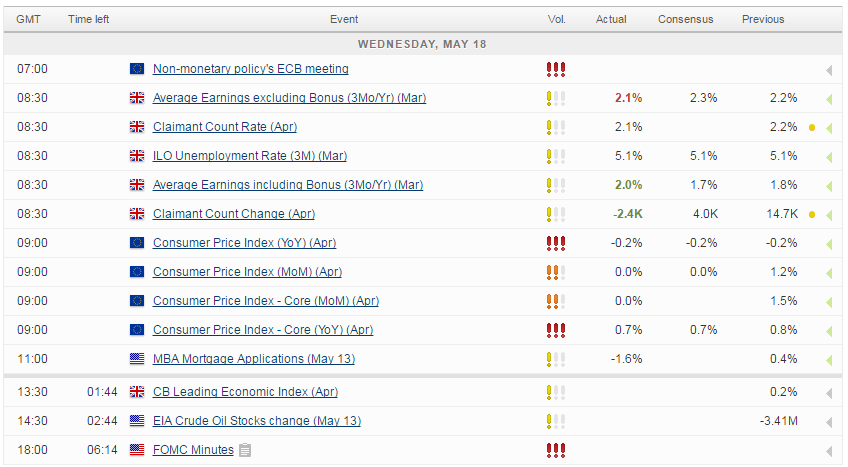

The FOMC minutes, released later on today, will now be even more important as investors look for further signs that future rate hikes have been incorrectly priced by the markets and that June is actually a live meeting. Until yesterday, the implied probability of a hike was only 4% with investors absolutely convinced that this was off the table. Already this has risen to 15% and the timing of the next hike brought forward to November, from December. If the minutes echo the comments from Fed officials as of late, we could see the markets come even more in line with what the Fed’s plans.

Source – CME Group FedWatch Tool

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.