We could be in for another rocky week in the markets with particular focus back on the central banks as we get the latest monetary policy decisions from the Federal Reserve and Bank of Japan, the latter of which is expected to announce new stimulus measures.

There’s also a number of key economic reports being released throughout the week which should keep traders on their toes. The bulk of this comes towards the back end of the week, including first quarter GDP reports from the U.K. and U.S. and inflation data from the eurozone and U.S. which could result in some caution in the markets over the next day or two. Especially with the central bank decisions also due on Wednesday and Thursday.

I don’t think the message from the Fed after the meeting on Wednesday will differ to much from previous rhetoric as they’re going to want to avoid rocking the boat too much, especially in a week that could include more easing from the BoJ. The central banks appear to have made a real effort in recent months to stabilise the markets following periods of panic in August and January, and the results have been very positive.

I still believe we’ll see two rate hikes from the Fed this year and the FOMC statement will confirm its intentions to do so. What the markets are looking for though is an idea of when we can expect them, with the June and December meetings looking the most likely. The Fed will want to be very clear in its statement, with a press conference not accompanying it, but in keeping with its standard procedure, will want to give itself plenty of wiggle room. I imagine the message will be that two hikes are likely, with June being live but as always, everything is data dependent.

As for the BoJ, it has so far resisted the temptation to act and weaken the yen, following a substantial appreciation this year, but I don’t expect it to put this off any more. There has been speculation over the last week that it could target the lending rate, taking it into negative territory for the first time which could get a better reception in the markets than its previous experiment with the deposit rate. It could also be accompanied by an increase in its quantitative easing program, the combination of which should halt the rally and may bring the yen back to a more bearable level. Should the BoJ succeed, it could be enough to send the yen back to the high teens against the dollar, although as we saw last time they announced new stimulus measures, these markets don’t always react in the way we would normally expect.

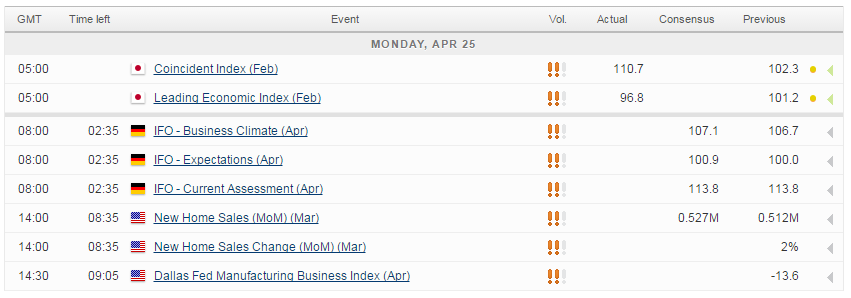

Corporate earnings season also continues this week and is likely to continue to be a major influence of market sentiment, particularly in the early part of the week. There are some economic reports worth monitoring today though, with the German Ifo business climate number for April being released this morning, followed by U.S. new home sales for March later this afternoon.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.