Like their counterparts in Europe, U.S. indices are expected to start the final trading session of the week in the red as earnings season continues to underwhelm on both continents and the economic data doesn’t give much to be happier about.

It’s worth noting that we are still broadly higher on the week but still, there is a feeling that we needed a decent earnings season to justify equities at these elevated levels, particularly in the U.S. where the Dow and S&P 500 are within touching distance of all-time highs. Even with the bar being set very low, U.S. corporates have so far failed to impress, let alone blow U.S. away.

Once again we seem to be in a period of restructuring and earnings growth driven by cost cutting. While this is important, you’d hope at this stage of the cycle and with markets at these levels we’d be beyond this. I guess in this low growth environment, which could continue for some time, we need to get used to substandard revenue growth and earnings reliant on efficiencies. What this means for salary growth is yet to be seen, so far it’s not been good news.

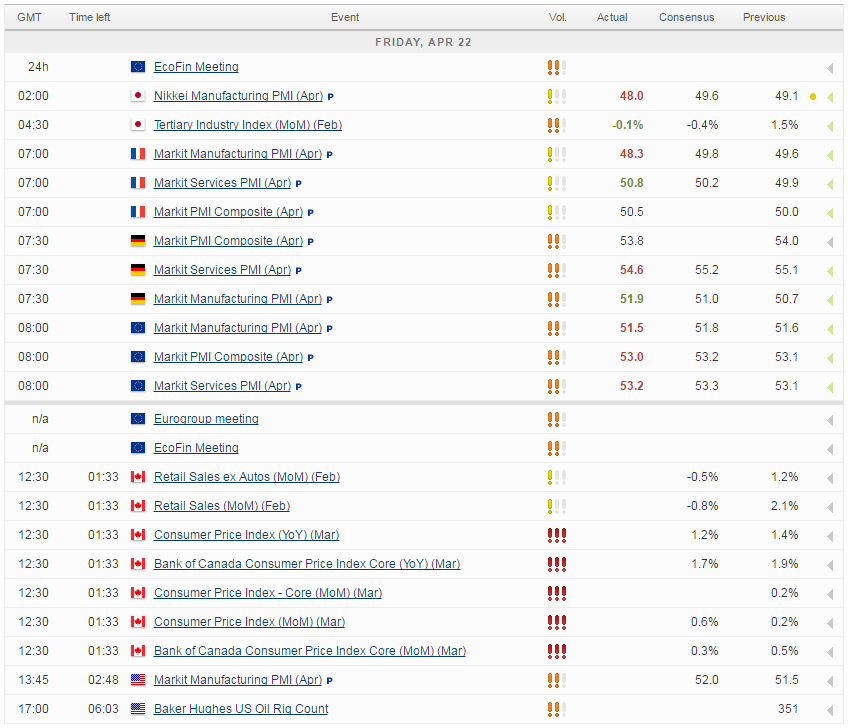

There are a number of other companies reporting earnings today which could provide a boost ahead of the market open, although given what we’ve seen so far I’m not overly hopeful. On the data front, we have the flash manufacturing PMI from the U.S. which is expected to point to slightly faster growth in April, following a prolonged period of slowing growth.

In Europe, finance ministers will meet today, with Greece’s first bailout review undoubtedly being top of the agenda. We’ve heard for weeks that the hope was a deal would be done in time for this meeting but that looks impossible now with eurogroup President Jeroen Dijsselbloem warning “Don’t expect any deals today”. That hardly comes as a surprise, given the history between Greece and its lenders when it comes to agreeing on reforms and spending cuts but it would be good to see some progress towards an agreement being made, rather than another saga that involves an 11th hour deal.

WTI and Brent crude are treading water on the day but continue to consolidate around important technical resistance levels. A break through yesterday’s highs could trigger a much broader move to the upside in oil but in the absence of a weaker dollar or any supply shocks, it may be tough to break through this key level.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.