The European Central Bank decision and press conference today may not be quite the event that it was in March but with the bazooka still warm following last month’s antics, President Mario Draghi may instead see today as an opportunity to take some of the fizz out of the euro, something he failed to do previously.

While it’s clear that the ECBs intentions last month were to emphasise that the stimulus package was intended to improve credit channels, not weaken the currency, I don’t think they quite expected the markets to respond as they did, with the euro ending the day up more than 1.5% against the dollar having been down more than 1.5% before the press conference. To make matters worse, the rally wasn’t done there and the euro now finds itself much higher than it was prior to the last meeting.

With central banks around the world appearing to have come to an agreement yet again not to target currency depreciation and instead deliver stability in markets that at times over the last eight months have gone into panic mode, it will be interesting to see how Draghi approaches the press conference today. I don’t think anyone is expecting further stimulus from the ECB today but they could use the press conference to take the edge off the euro, with a weak currency having been so important for what little recovery we’ve seen in the region.

Not to mention the fact that a stronger currency is only going to make attempts to return inflation to target that much more difficult, with the ECB already falling well short of that. I wonder whether Draghi may reopen the door to even more negative rates or some other forms of stimulus, with his suggestion last month that they were done for now being behind the rally.

Draghi’s Rhetoric to Show ECB Near Limit

Also to come today we have U.K. retail sales early in the session, a key economic indicator given the importance of the consumer to the economy. While we’re expecting a small decline in sales in March, the figures when compared to a year earlier remain impressive and are likely to continue to support growth, in what could be an otherwise challenging few months for the country in the lead up to the referendum in June.

Oil prices are rising again early in the session on Thursday having rallied strongly yesterday following the crude inventory numbers which were slightly below expectations. With oil now trading at its highest level since early December and showing little sign of easing up, despite no deal being reached in Doha and the strike in Kuwait being resolved, I wonder whether what we’re seeing here is partially a demand side story, with Chinese data having improved as of late, and partially an assumption that further supply disruptions are on the horizon, following such a long period of very low prices.

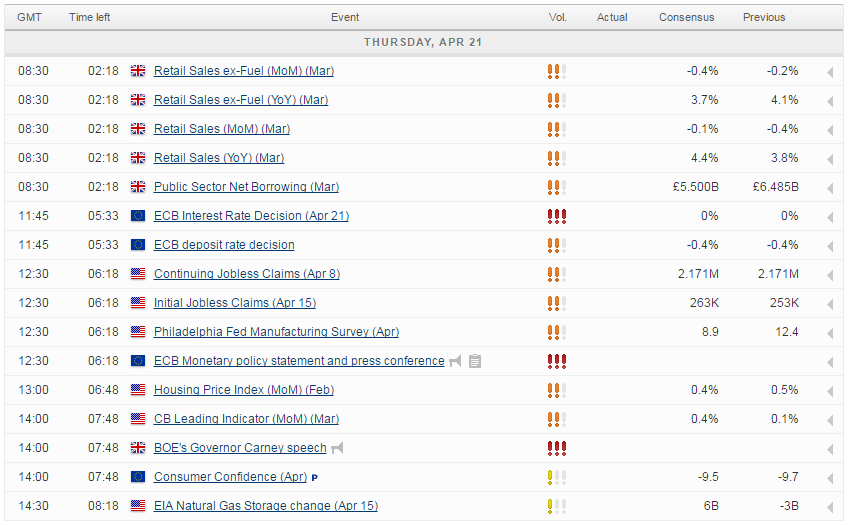

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.