We’re seeing some caution in the markets ahead of the latest FOMC decision on Wednesday as investors look to the central bank for clues on the pace of interest rate hikes in the U.S.

U.S. indices are expected to open only moderately higher, in line with the kind of moves we saw in Asia overnight which is quite common in the build up to yet another important Federal Reserve event. We’re seeing slightly stronger gains in Europe so far, driven primarily by similarly positive moves in oil early in the session.

What makes this FOMC decision particularly interesting is the fact that we’ll get the latest economic projections from the central bank and the dot plot which lays out the expected path of interest rates from the Fed’s policy makers. Given that this comes at a time when there’s so much uncertainty among market participants as to the timing of the upcoming rate hikes, this could spur quite a lot of volatility in the markets.

While a change in interest rates is extremely unlikely today, it’s the path of rate hikes that has caused so much confusion in the markets. When the Fed first hiked interest rates in December, it indicated that it intends to raise rates another four times this year which raised a lot of eyebrows and the doubters were out in force.

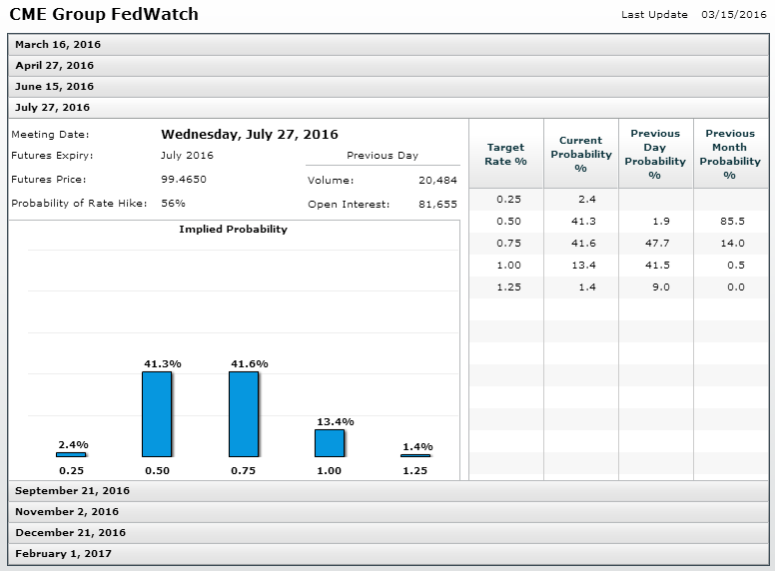

At times this year, markets have even priced in no further rate hikes this year, although now it seems they are coming round to the idea once again, with Fed Funds futures pricing in a 56% chance of a rate hike in July and 79% chance of one by the end of the year.

Some people are even coming round to the idea that there’ll be more than one before the end of the year, which I personally believe it very likely.

As we’ve seen in the cases of many other central banks so far this year, communication from the Fed is going to be key, which makes Chair Janet Yellen’s press conference all the more important. Any slight miscommunication from the central bank can send the markets into a frenzy, as we saw in the case of Mario Draghi and the ECB last week, which means Yellen will have to be very careful to get the correct message across. This will preferably be in line with the economic projections and dot plot so as to avoid any further confusion which is what has led to so much volatility and mispricing at times in recent years.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.