Fed Had Forecasted 4 US Rate Hikes in 2016 Changing Macro Conditions Should Force a Revision

U.S. Federal Reserve Chair Janet Yellen will testify twice during the week when she delivers the semiannual Monetary Policy Report to the House and Senate special committees. Each session will have the Fed Chief release a prepared statement and then take questions from Committee members. Given that there is no Federal Open Market Committee (FOMC) meeting in February this gives Yellen a chance to reassure the market about the Fed’s intentions regarding potential monetary policy decisions. The March FOMC meeting is not expected to bring a rate hike, but stronger wages and an improvement on the unemployment rate will give the Fed food for thought.

U.S. economic indicators have been mixed. Employment is still considered the cornerstone of the recovery, but consumer and corporate spending are still lagging. U.S. retail sales to be delivered later this week should keep underperforming as consumers opt to save. The negative effects on inflation like the tumble in energy prices have not resulted in gas savings going to retailers. The rise in wages will give some breathing room to the central bank as it keeps in 2 percent inflation target.

Chair Yellen will face questions from the House Financial Services Committee on Wednesday, February 10 at 10:00 am EST and then from the Senate Banking Committee on Thursday, February 11 at 10:00 am EST. Investors will be on the lookout for comments on the next meeting of the Federal Open Market Committee (FOMC) on March 15 and 16.

The EUR has appreciated 1.09 percent versus the USD in the last 24 hours. The rout in global stock markets has made investors look for safe havens. The USD is weaker across the board versus major pairs as it awaits the testimony of Fed Chair Yellen. The four hikes the Fed mentioned at the end of last year gave the USD a boost, which is now being discounted as those rate hikes will not all materialize. It is up to Yellen to reassure markets that higher rates are coming, but with some delays.

Fed Chair Gets Chance to Add Clarity to Forecasts

The Fed forecasts 4 interest rates in 2016. The central bank opted to hold rates during the December meeting and fundamentals other than the jobs component have slowed down even more so between this week and the middle of March the U.S. economy would have to improve significantly for the Fed to hike again. It is too early for the Fed to cut its forecasts, but then again the street has already done so, with 2 to 3 rate hikes instead of the 4. Given the fact that this is an American presidential election year that could also limited the ability of the Fed to modify monetary policy during political sensitive periods leading up to the final vote.

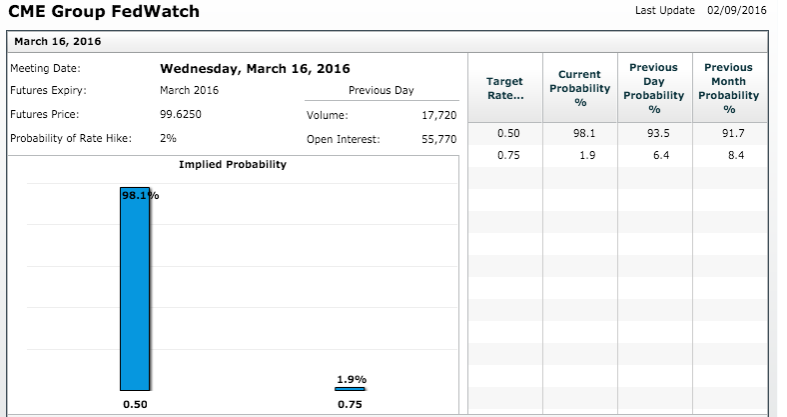

The CME Group’s FedWatch tool show how much the market thinks the Fed will stand pat in March. The 30-day Fed Fund Futures prices are used to measure how much the market thinks the likelihood of a rate change will happen at the next FOMC meetings. For March 16 the probability is 98.1 percent that the rate will remain unchanged at 0.50 percent. Even with improved inflation measures, the market believes macro conditions will prevent the Fed to raise rates.

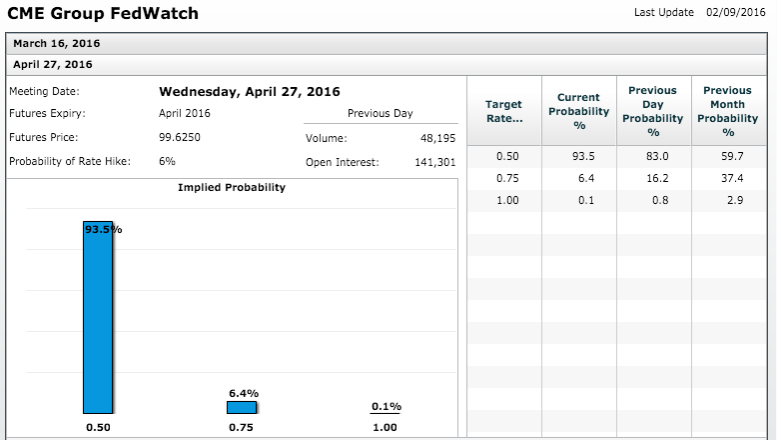

The April FOMC has likewise reduced probabilities of a rate hike, although it does manage to jump to 6 percent, with 93.5 percent of no change.

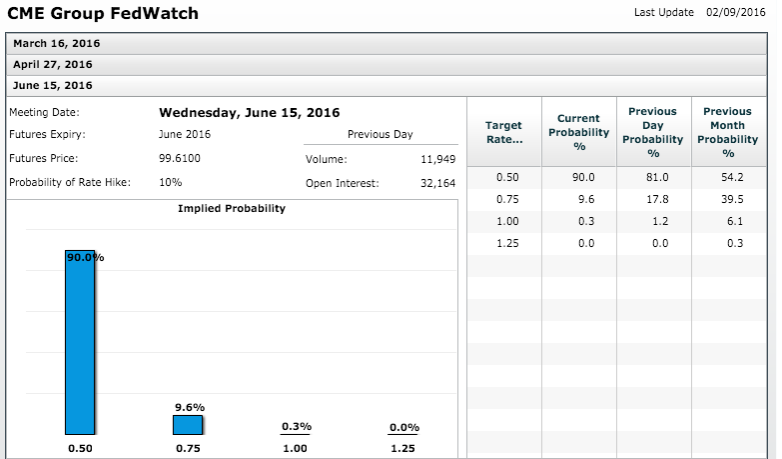

Going all the way to June the probabilities remain very low for a change in the benchmark interest rate.

The market expectation is for the Fed to keep rates unchanged given the softness of U.S. data and the overall global slowdown. This morning the International Energy Agency made comments that brought the price of oil back under $30 for West Texas and close to $30 for Brent crude. With low inflationary pressure despite the wage silver lining, it is unclear the Fed will follow through with subsequent rate hikes.

On the other hand Yellen is not expected to be dovish, even as she could in fact take the March FOMC off the table. Due to the audience that she will testifying for and their subsequent questions it could also be derailed by political agendas. The role of the Fed has been questioned before and could pop up again during Yellen’s two stops.

USD events to watch this week:

Wednesday, February 10

4:30am GBP Manufacturing Production m/m

10:00am USD Fed Chair Yellen Testifies

10:30am USD Crude Oil Inventories

Thursday, February 11

8:30am USD Unemployment Claims

10:00am USD Fed Chair Yellen Testifies

5:30pm AUD RBA Gov Stevens Speaks

*All times EST

For a complete list of scheduled events in the forex market visit the MarketPulse Economic Calendar

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.