It’s been another tense week in the markets, during which the FTSE has joined the CAC and DAX in bear market territory and pessimism among the investing community has continued to grow.

Fear and panic has seriously gripped the markets in the opening few weeks of the year, triggered primarily by instability in Chinese markets but spread throughout the developing and developed world. Plunging oil prices have only dampened the mood further and suddenly, only a month on from the Fed raising interest rates to reflect the improving economic fundamentals, there’s talk of possible global recessions and dark days ahead.

Personally I think all of this hysteria is a little overdone and what we’re actually experiencing right now is a very natural and necessary correction in the markets. Of course there are numerous challenges facing the global economy this year but that in itself doesn’t mean we are headed for disaster. The liberalisation of Chinese markets, the result of which appears to be responsible for much of the panic, was never going to be a smooth process and more weeks like those in August and the start of the year are likely but that does not mean that it’s economy is therefore on the verge of a hard landing.

It will be interesting to see if some calm returns to the markets in the coming weeks or whether we’re just in for a bumpy ride in the first quarter. The ECB hinting at more stimulus in March may help to bring some much needed stability back to the markets, as could the fact that we’ve now had two consecutive weeks of relative stability in the yuan, the depreciation of which sparked much of the panic.

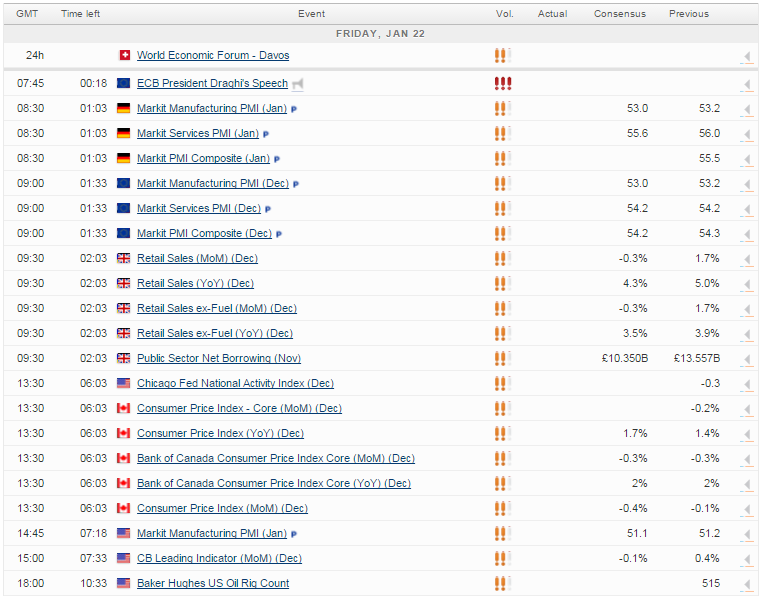

For now, it will be interesting to see whether the markets continue to sell into any rallies, which has been the case since the start of the year. Fortunately, a positive session in the US and Asia overnight could be the catalyst for a second day of gains in Europe, to end the week. There’s also plenty of economic data being released today, starting with the flash manufacturing and services PMIs from the eurozone, then retail sales data for the UK. A healthy batch of data may just be what the doctor ordered.

The FTSE is expected to open 59 points higher, the CAC 68 points higher and the DAX 185 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.