European markets have had a positive start to trading on Thursday, as investors eye the ECB press conference for insight into how the extremely volatile start to the year has impacted its position in the coming months.

Indices are trading around 1% higher this morning, a day after many entered bear market territory following what has been a gruelling start to the year. Any rallies in equity markets this year have been very short-lived and seized upon by investors as an opportunity to exit long positions or short the market. Given how gains today are dwarfed by Wednesday’s declines, I see little reason to believe this is going to be anything other than a dead cat bounce. The market looks very bearish right now and confidence has been shattered by the repeated large sell-offs.

Given the recent events in the markets, investors will be desperate to know how the central banks will respond, given the Federal Reserve only last month embarked on its tightening cycle and the ECB announced additional monetary stimulus, albeit far less than had been hinted at. Central Banks like to claim that they don’t make monetary policy decisions based on short-term market moves but when many indices are almost 10% down in the opening three weeks of the year, circumstances are far from normal.

Central banks also have to contend with yet another sharp decline in commodity prices this year which is going to apply even more deflationary pressure to an already low inflation environment. All things considered, while I don’t expect any action from the ECB today, I do expect President Mario Draghi to offer a fine balance between playing down recent market moves as not being reflective of the fundamental picture, and assuring investors that the central bank stands ready to act if necessary, which could now come earlier than many expect.

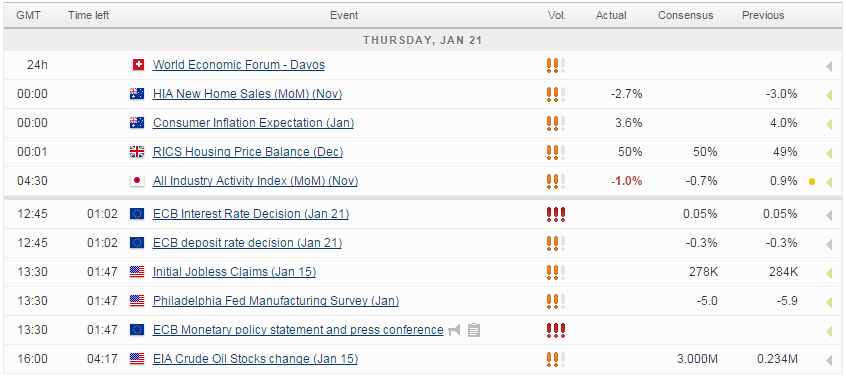

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.