Just as we thought we were seeing some stability return to the markets, European futures trade heavily in the red ahead of the open on Wednesday, once again showing just how sensitive global sentiment is to Asian markets at the moment.

Chinese markets remained volatile overnight following what was quite an encouraging start to the week. Mixed data from China on Tuesday appeared to spur hopes of additional stimulus which may have helped drive gains in Shanghai on Tuesday, although given that the index rallied off August’s lows, I do wonder if there were other forces at play.

Japanese stocks have been some of the hardest hit recently and that remained the case overnight as the appreciation of the yen continues to weigh. The yen is now trading more than 7% of its highs from the middle of last year and more than 5.5% lower than a month ago, as investors seek the safety of the currency after markets went into meltdown at the start of the year. With further gains possible in the coming weeks, Japanese stocks could remain under pressure for the foreseeable future, with exporters in particular very exposed to the surge in the currency.

This morning we’ll get the latest labour market data from the U.K. and once again, the numbers are expected to be rather mixed. Unemployment is seen remaining at 5.2% in November but wage growth is slowing having accelerated since the summer. Average earnings including bonus’ are expected to have risen by 2.1% which is not going to be enough to convince the Bank of England that the time for rate hikes has arrived. Not when inflation remains extremely low and the global economic environment so challenging.

U.S. inflation data will follow this afternoon, which will take on increased importance – despite not being the Federal Reserve’s preferred measure – following its decision to begin the tightening cycle last month. The decision to move on the expectation that inflation will follow was seen as a risky move by many and we have to assume that if the data doesn’t follow, then the path of rates will be slower than the central bank is currently planning. Inflation is expected to rise to 0.8% for December, as the initial decline in energy prices at the end of 2014 begins to drop out of the annual comparison.

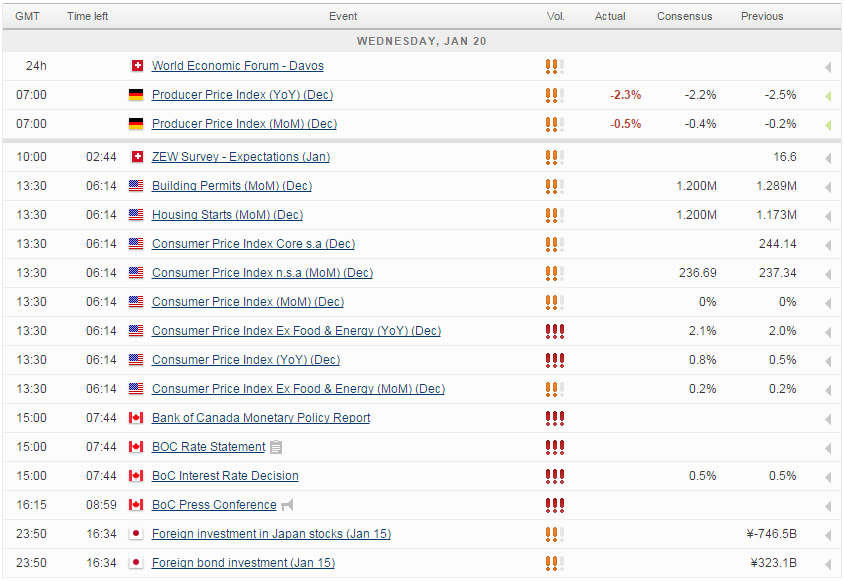

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.