The first week of the new year has certainly been an eventful one with Chinese markets once again displaying their instability and unpredictability. While measures taken by the central bank and regulator on Thursday appear to have alleviated the panic somewhat, the end of the week could yet see more volatility as the U.S. releases its latest jobs report for December.

Unusually, the U.S. jobs report has, to an extent, fallen off the radar this week, with Chinese market activity instead grabbing all of the attention as instability and panic spread through global markets. There has been a clear shift to safe havens in recent days, as investors sought cover from the backlash in equity markets and other risk assets.

We could see much of this unwound today though after efforts by the China Securities Regulatory Commission and People’s Bank of China appear to have calmed investors overnight, with the Shanghai Composite now up 2.6%, following some wild swings earlier in the session. The decision to remove the circuit breakers that have caused so much concern this week appears to have contributed to these calmer markets, as has speculation of currency market intervention in an attempt to shore up the Yuan, the sharp depreciation of which has triggered much of this weeks’ chaos.

While some form of stabilisation in Chinese markets may help end the week on a more peaceful note, there is still the small matter of the U.S. jobs report to contend with which could get markets riled up once again. The first rate hike from the Federal Reserve may now have passed but the next one is unlikely to be far away and U.S. data is going to be key in determining when that will come.

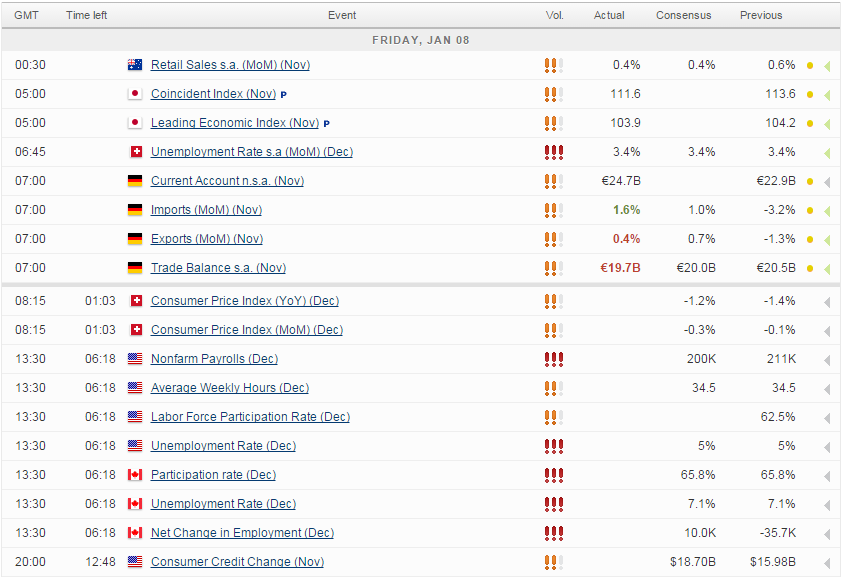

The jobs report is arguably the most important U.S. economic releases, given the obvious focus on job creation, unemployment and wages. Future inflationary pressures should begin to build as the slack in the economy dwindles away and wages grow, both of which can be seen in this report so it’s no surprise that this can quite often drive a lot of market volatility. Another strong report is expected for December with 200,000 jobs created, earnings growing by 0.2% and unemployment remaining at 5%, which could encourage the Fed to contemplate another hike as early as March. That said, given all of the turmoil in China this week, the Fed may be tempted to hold off a little longer on the second hike, just as it did following similar events in August, just before the meeting in September when many thought it would begin its tightening cycle.

The FTSE is expected to open 2 points higher, the CAC 11 points higher and the DAX 21 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.