U.S. indices are poised for another woeful session on Thursday after circuit breakers were once again triggered in China overnight, the knock-on effect of which has pushed global equity markets deep into negative territory and prompted a surge in safe haven flows.

The year has got off to a dreadful start driven primarily by activity in Chinese markets, where the Yuan has weakened dramatically and equity market trading has ceased for a second session after the CSI 300 index fell more than 7%. The move took only 15 minutes to materialise which seriously highlights the extent to which investor sentiment has been shattered this week, not helped of course by the introduction of new circuit breakers that appear to have exacerbated the problem and prompted even more panic selling.

Based on current futures levels, the S&P is on course to open around 1,948, just shy of 5% below the closing level on the final trading day of 2015. Given the weak sentiment in the markets at the moment, I struggle to see this being reversed before the end of the week, particularly when considering that the ban on selling for large investors expires on Friday. Of course, this will be replaced with restrictions on selling but this could still add to the downward pressure on the final trading day of the week. Moreover, given the fragile sentiment in the markets at the moment, the mere knowledge that a number of possible large sellers will return to the markets could be rather self-fulfilling. Under the circumstances, I would not be surprised to see circuit breakers triggered for a third time on the final trading day of the week, barring any significant central bank or regulatory intervention.

Not helping indices on Thursday is another strong sell-off in many commodities, with Brent and WTI crude in particular being battered again this morning. Gold is one of the few commodities performing well in these markets, benefiting from its safe haven appeal, which has been absent at times over the last 18 months, or so. Elsewhere we’re seeing strong risk aversion plays with bonds performing well, along with the Swiss franc, yen and the euro. Going forward, focus is likely to remain on the China story which should continue to weigh on sentiment. We’ll get jobless claims data from the U.S. but under the circumstances, this could fall under the radar somewhat.

The S&P is expected to open 42 points lower, the Dow 391 points lower and the Nasdaq 126 points lower.

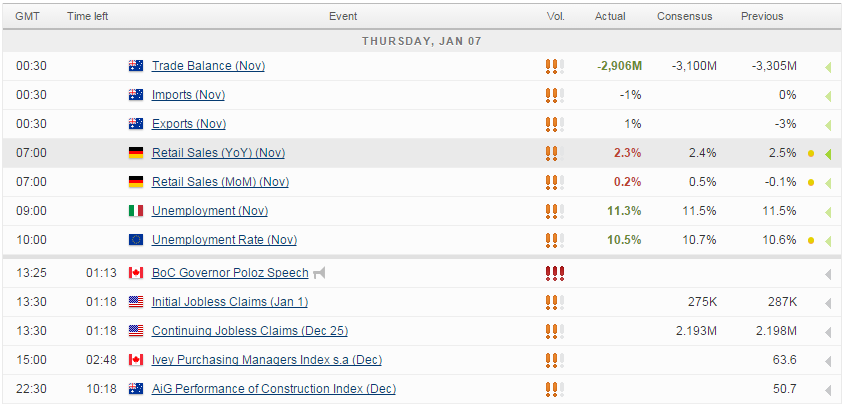

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.