We have a massive day in store for the markets on Wednesday which is likely to be capped off this evening with the first rate hike from the U.S. Federal Reserve in almost a decade.

The question of when the Fed will eventually raise interest rates has been discussed in great depth for the majority of this year and even now, while the markets are all but convinced it will happen today, people are very split on whether it should in fact happen.

The main argument against a rate hike has come from a lack of inflation in the U.S. and with the growing divergence in monetary policies with other central banks, there is a good chance that this could remain low over the next year or so. However, the Fed is more concerned about the potential for inflation to pick up rapidly when it does start to rise and would rather manage this early with small gradual hikes, than have to tackle it head on more aggressively a year or so down the line. This is the smart approach in my opinion as it carries the least risk of severe economic consequences, with the economy currently able to cope with small hikes.

It should also be noted that yesterday’s core CPI data showed prices up 2% from a year earlier, in line with the Fed’s target. Of course, this is not the Fed’s preferred inflation measure but it does suggest that inflationary pressures are present in the economy and that even this is not as bad as some would have us believe.

The main concern is that, as with the ECB a couple of weeks ago, the Fed will get cold feet and under-deliver, either with a marginal hike, say from 0-0.25% to 0.25%, or even worse, none at all. This would create major credibility issues, a common occurrence with many central banks this year, and leave the markets questioning whether a “more transparent” Fed is actually of any benefit at all. It could also create huge volatility for the markets, which generally now reflect a central bank that has begun its tightening cycle. That could mean significant pain for the dollar and even US equities which have done quite well during the early stages of previous cycles.

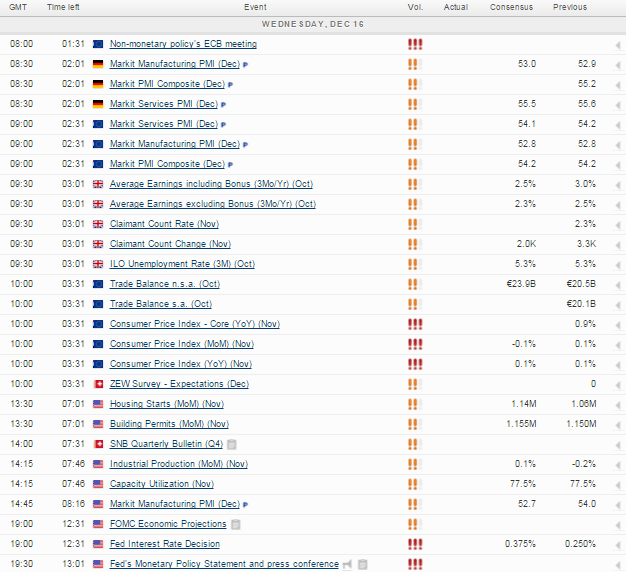

There is also a lot of economic data being released today, although I’m not sure it will have quite the same impact that it ordinarily would. Traders can often sit on the fence more than usual ahead of such a huge announcement, not that we’ve seen too much evidence of this at the start of the week.

Flash PMI readings from the eurozone will start being released shortly after the European open and are expected to be relatively unchanged from the previous month. We’ll also get the latest jobs data from the U.K., which is expected to show unemployment remaining at 5.3%, while earnings growth is expected to have cooled slightly in October to a still very reasonable, particularly in this low inflation environment, 2.5%. The final reading of eurozone inflation for November will follow this and is expected to be unchanged at 0.1%, followed by housing data from the US early this afternoon.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.