It’s jobs report day in the U.S. and with less than two weeks to go until the Fed meeting, today’s data could well be the final hurdle on the path to the first rate hike in almost a decade.

The Fed has repeatedly claimed its decision is data dependent and so far, the impression we’ve been given is that it’s been sufficient to warrant a hike. Last month’s jobs report was extremely strong, so much so that even a weak report this month could be deemed acceptable as long as the average of the two met the Fed’s expectations.

I think the Fed’s mind is probably 95% made up at this stage and it will take something hugely significant to change it. Today, that would be a substantial downward revision to the October data and a very weak report for November, so that the total number of jobs created across the two months fell below 250,000. That seems extremely unlikely to me at this stage and even if that happened, I believe there would still be a strong willingness within the Fed to raise rates.

With that in mind, I don’t think today’s report will be as significant as many think. I think we’ll see a decent report that will all but guarantee a start of the tightening cycle on 16 December, barring a broader more significant shock that could derail it. This could be something similar to what we saw in August when emerging markets experienced massive outflows which caused a shock throughout global markets. I still believe this is what prevented the Fed raising rates in September but don’t expect it to happen again. Emerging markets have adjusted and priced in the hike, it’s time for it to happen.

Today’s other key risk event is the semi-annual OPEC meeting which is already underway. While there is clearly appetite within OPEC for production cuts as prices linger around multi-year lows and containers near capacity, no official cut is expected to be announced today. It has been suggested that Saudi Arabia, OPEC’s most influential member, may be open to a coordinated production cut with non-OPEC members so as to retain market share, but this has not yet been confirmed and any deal could be difficult to broker. That said, should we get confirmation that the group is open to discuss a production cut, we should at the very least find stability in oil prices and they could even move off their lows.

The S&P is expected to open 13 points higher, the Dow 99 points higher and the Nasdaq 23 points higher.

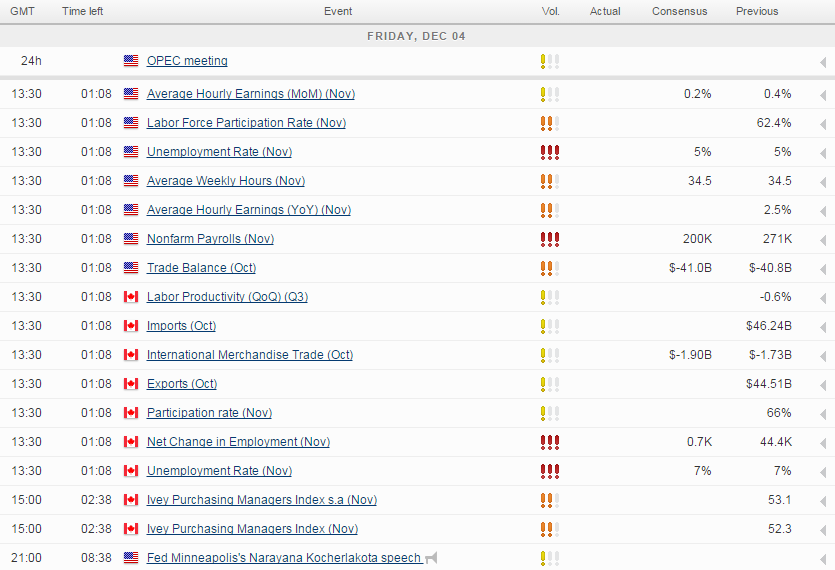

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.