We are now approaching the business end of the week in the markets and today we have some important economic data and Fed speeches that will be of interest to market participants.

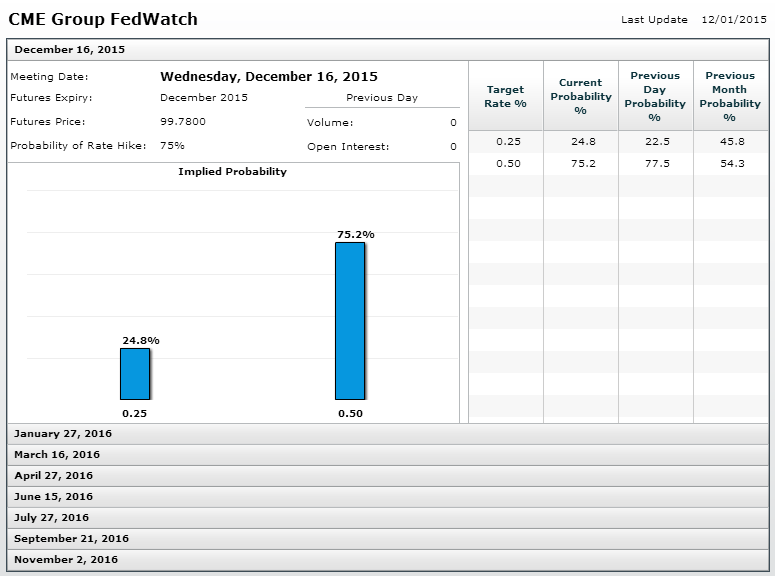

Ahead of the open, U.S. futures are pointing slightly higher, building on gains yesterday that came despite the disappointing ISM manufacturing data. The survey once again highlighted the difficulties facing the sector as a result of the strong dollar, just as the dollar index closes in on March’s 12-year highs. Expectations for a December rate hike fell on the back of the data, with Fed Funds futures now pointing to a 75% chance of a hike, down from 78% previously. This is only a small decline and reflects the fact that the manufacturing sector only accounts for 12% of total GDP in the U.S..

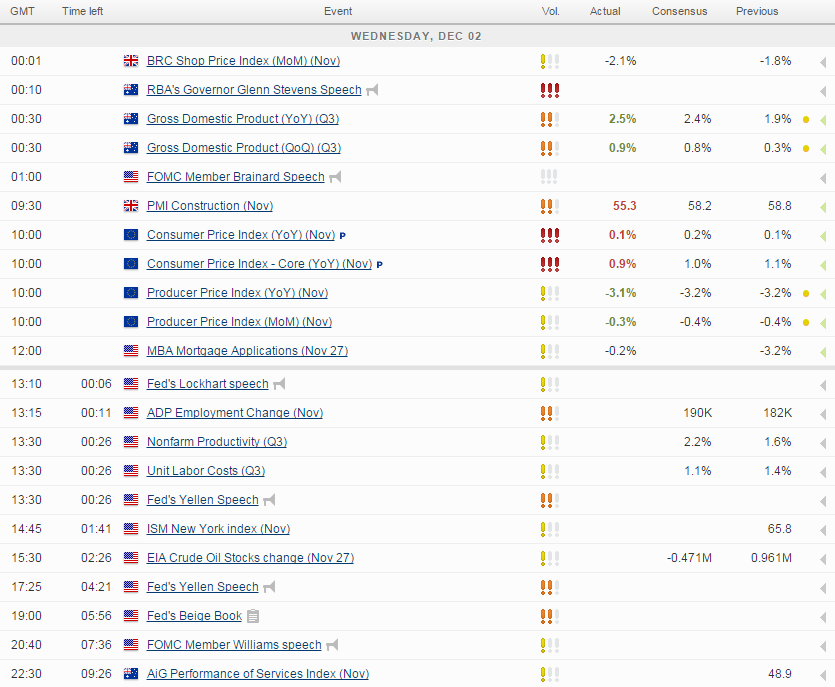

With that in mind, the Federal Reserve may be more concerned with metrics such as unit labour costs and productivity as these offer good insight into possible future inflationary pressures. Of course, some additional costs can be absorbed by companies, particularly in the short term by those already facing stiff competition from abroad, but quite often this is passed onto the end consumer. Any sign that output costs are rising could vindicate a hike by the Fed even if those inflationary pressures are not currently present.

The ADP non-farm employment report will also be of interest ahead of Friday’s widely anticipated jobs report. While the first reading has proven to be a fairly inaccurate estimate of the non-farm payrolls number, as last month’s data shows, it can often provide insight into when the market is overly bullish or bearish on expectations for the official number. For that reason alone, it tends to be followed fairly closely by the markets.

Fed Chair Janet Yellen will speak at The Economic Club of Washington DC today, in what will be a very closely followed speech ahead of her testimony in front of Congress tomorrow. The next couple of weeks is going to be massive for the Fed and it’s so important that the market is prepared for whatever it decides to do. While I doubt Yellen will comment on the actions of the ECB tomorrow, it would be interesting to see how, if at all, this influences the Fed’s own decision making. Moreover, ahead of Friday’s jobs report, it would be interesting to know what it would take for the Fed to reconsider hiking rates in two weeks. Of course this isn’t the only data that matters but it is one of the most important releases and could prove influential. We’ll also hear from other Fed officials today including Dennis Lockhart and John Williams.

The S&P is expected to open 3 points higher, the Dow 18 points higher and the Nasdaq 10 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.