Inflation data from the U.K. and the U.S. will take focus on Tuesday as both central banks try to weigh up the perfect time to begin raising rates, given the much improved economic fundamentals against the backdrop of a low inflation environment. As of recently, both appear to have come to very different conclusions with the Federal Reserve signalling its intentions to raise rates in December while the Bank of England is more likely to wait until late next year.

Still, that can and quite often does change so the inflation data is still worth keeping a very close eye on. The key concern of the BoE appears to be that core inflation is showing little sign of improving despite tighter labour market conditions but I don’t think it would take too much for the concern to shift from few signs of inflationary pressures to fears that it will rise too rapidly once it starts, which appears to be the fear at the Fed.

U.K. CPI is expected to remain in deflation territory in October, with the core reading at 1%, highlighting that it’s not just energy and food prices that are bringing the deflationary pressures, although they are largely responsible. The U.S. reading of 0.1% isn’t exactly much better but the core 1.9% figure is. That said, it should be noted that while this is the earlier inflation release, it’s not the Fed’s preferred measure so we can’t place too much significance on it.

We’ll also get economic sentiment data from Germany and the eurozone this morning, both of which have been spiralling lower over the course of this year. Economic sentiment, as measured by ZEW, is at a 12 month low, while in the eurozone we’re at the lowest in 11 months. Both are expected to see a small boost in November although we’ll have to see a lot more than that if the euro area is going to break out of this long period of sluggish growth next year.

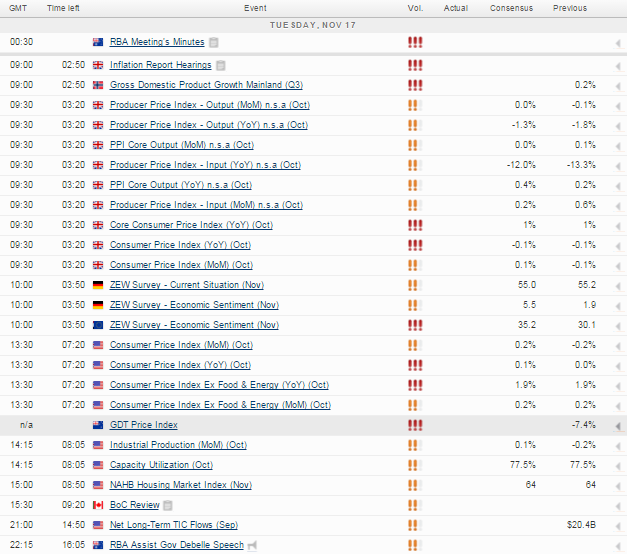

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.