After yesterday’s hawkish FOMC statement we should prepare for even more scrutiny of every U.S. economic release, starting with today’s GDP reading, as investors once again try to anticipate whether or not we’ll get a rate hike in December.

In keeping with the Fed’s policy under Chair Janet Yellen, the Fed yesterday left the door wide open to a rate hike in December without explicitly committing to it, instead once again putting the emphasis on economic data while dropping its warning on global risks to the U.S. economy.

Today’s GDP data will be the first since the FOMC statement to come under additional scrutiny and if it falls short of the already modest expectations, the doves will take an early lead.

Fed Funds futures already suggest the market is fairly split on whether we’ll see a rate hike this year and we could well see a fierce tug of war over the next six weeks as investors try to get ahead of the game, unless the data begins to swing significantly one way or the other.

We know already that the U.S. economy faced some difficulties in the third quarter, hence expectations of only 1.6% on an annualised basis, but if these are more extreme than first thought or not as bad, the markets will be quick to jump on it. It’s worth remembering that this is the advanced reading of GDP and will be revised twice more in the coming months, which can often bring very different results. That said, given the sensitivity to the data that we’re likely to see over the next six weeks, I don’t expect that to get in the way of the markets overreacting to a single preliminary release.

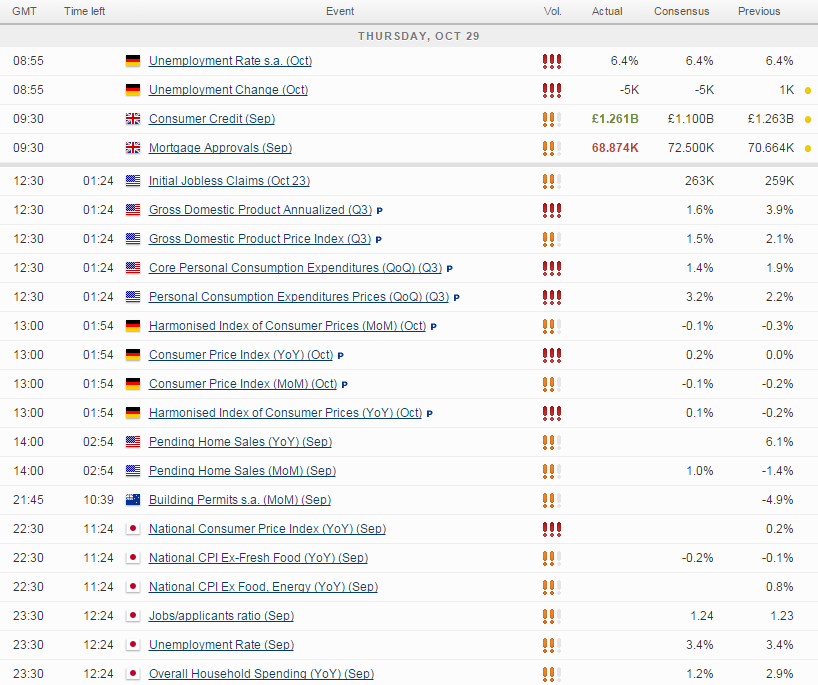

Also being released today we have jobless claims data as well as pending home sales for September, neither of which are likely to come under the same kind of scrutiny but will still be monitored closely. We’ll also hear from Dennis Lockhart, Federal Reserve Bank of Atlanta President and voting member on the FOMC, as he speaks at the Workforce Development Panel Discussion in Washington DC.

The S&P is expected to open 8 points lower, the Dow 86 points lower and the Nasdaq 23 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.