There is clearly some indecision in AUDUSD at the moment, with speculation that the Reserve Bank of Australia could cut interest rates only adding to the uncertainty that already exists thanks to a hesitant Federal Reserve.

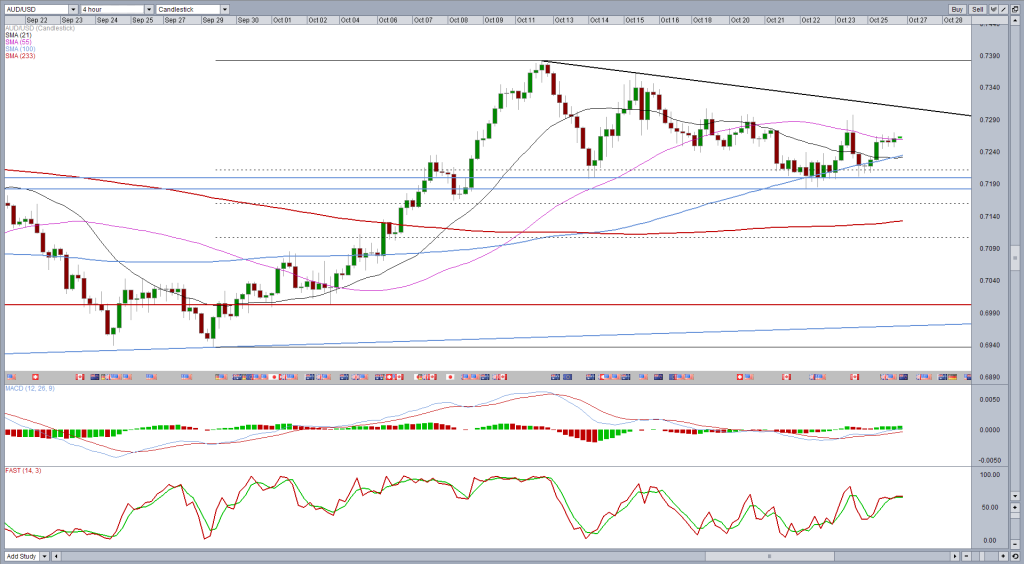

From a technical standpoint, the pair looks like it could be on the verge of a very significant break above the long term channel resistance. The recent correction following a decent rally at the start of October doesn’t currently appear to be anything more than that. What we have is something that resembles a flag or falling wedge, a bullish continuation pattern.

Moreover, 0.72 appears to be well supported at the moment. The pair did trade briefly below here at times but on each occasions the move below was bought into which has established quite a solid base between 0.7180 and 0.72.

With rate decisions to come from the Federal Reserve and RBA in the next eight days, the pair is likely to break out of this consolidation period fairly soon as, at the very least, we should get some more clarity out the monetary policy outlook.

If we see a break through the descending trend line – 5 September 2014 highs – and the 100-day simple moving average, this would be very bullish and suggest the long period of declines has come to an end, at least for a while.

The next notable resistance area could come around 0.7530-0.76, where the 233-day SMA crosses through a prior region of support and resistance.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.