Fed Indecision has already Sparked Reactions from Other Central Banks

Central bankers had to step up their dovish rhetoric ahead of the U.S. Federal Reserve rate statement. The Bank of Canada held the benchmark rate at 0.50 percent the same week that Canada elected a new government. The European Central Bank also held rates, but triggered EUR depreciation with President Mario Draghi’s comments on a further round of stimulus and rate cut that could come as soon as December. The USD was higher as interest rate divergence expectations grow, even if the Fed is not ready to hike.

The People’s Bank of China (PBOC) cut the main interest rate 0.25 percent on Friday. It is the sixth rate cut in a twelve month period. Stock markets around the world gained as the global low rate environment will continue.

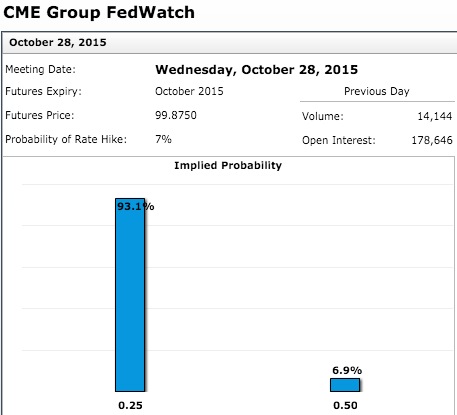

The probability of the Fed keeping the rate unchanged in October is 93.1 percent according to the CME Group FedWatch. Although some Fed members have said that an October rate hike was a possible, the market sees a Federal Open Market Committee meeting that is followed by a press conference, like the one in December, as having a higher chance of delivering a rate hike announcement. The Fed will publish its rate statement on Wednesday, October 28 at 2:00 pm EDT.

For the full tool go the CME Group FedWatch site

Fed inaction has put the Bank of Japan (BOJ) in a tough spot. BOJ Governor Haruhiko Kuroda is expected to announce an increase to the bond buying program to boost growth as the latest inflation data has disappointed. The Bank of Japan will deliver a tentative announcement late on Thursday, October 29 and an outlook report and press conference on Friday, October 30 at 2:00 am EDT.

Monday, October 26

5:00am EUR German Ifo Business Climate

5:45pm NZD Trade Balance

Tuesday, October 27

5:30am GBP Prelim GDP q/q

8:30am USD Core Durable Goods Orders m/m

10:00am USD CB Consumer Confidence

8:30pm AUD CPI q/q

Wednesday, October 28

2:00pm USD FOMC Statement

2:00pm USD Federal Funds Rate

4:00pm NZD Official Cash Rate

4:00pm NZD RBNZ Rate Statement

Thursday, October 29

8:30am USD Advance GDP q/q

8:30am USD Unemployment Claims

8:00pm NZD ANZ Business Confidence

Tentative JPY Monetary Policy Statement

Friday, October 30

2:00am JPY BOJ Outlook Report

Tentative JPY BOJ Press Conference

8:30am CAD GDP m/m

8:30am USD Employment Cost Index q/q

*All times EDT

For a complete list of scheduled events in the forex market visit the [MarketPulse Economic Calendar](http://www.marketpulse.com/economic-events/)

October FOMC Not Expected to Bring Surprises

The Federal Reserve seems to have talked itself into a corner regarding the timing of the first rate hike. Communication is at the heart of the problem. Ever since the Taper Tantrum, which was spearheaded by Janet Yellen, the American central bank has struggled to communicate clearly its intentions to the market. There was almost no transition as the Fed abandoned forward guidance and started using data dependency as a way to set expectations.

The June and September FOMC meetings have come and gone, and with them two solid candidates for a rate hike. Global economic conditions have changed and the U.S. recovery is in question if the speed of the headwinds escalates.

The CME Group Fed Watch calculates the probability of a change in the benchmark rate by using the future contract prices. The more the Fed has communicated with the market via rate statements the more the probabilities of sooner rather than later have evaporated. October has always had a lower probability given the fact that it does not have a press conference following the release of the statement. October has a 6.9 percent probability of a rate hike, while December improves with a 37 percent.

The EUR/USD fell after the ECB President Mario Draghi’s dovish comments suggest there will be an increase in the size of the easing measures to help the Eurozone economy escape deflation. The Fed has no pressure to act as opposed to other central banks whose verbal interventions are falling on the deaf ears of the market. The lack of a clear announcement on the timing of the first rate hike in the U.S. has global policy makers scrambling to adjust their monetary policies to get the most bang for their buck as it could all be for naught if the U.S. does decide to move forward with its awaited rate hike.

USD events to watch this week:

Tuesday, October 27

8:30am USD Core Durable Goods Orders m/m

10:00am USD CB Consumer Confidence

Wednesday, October 28

2:00pm USD FOMC Statement

2:00pm USD Federal Funds Rate

Thursday, October 29

8:30am USD Advance GDP q/q

8:30am USD Unemployment Claims

*All times EDT

For a complete list of scheduled events in the forex market visit the [MarketPulse Economic Calendar](http://www.marketpulse.com/economic-events/)

BOJ Likely to Deliver End of October Easing Boost

The Bank of Japan is no stranger to Halloween surprises. Last year it spooked markets with an unannounced increase to its stimulus program after the economy failed to grow according to plan. The sales tax hike introduced last year was to blame, but not other factors have put into question the lofty goals of Prime Minister Shinzo Abe. Abenomics introduced three arrows as the main drivers of growth in Japan. The only one which has had any success at all is the monetary policy push by the Bank of Japan. Abe has introduced a sequel to his growth strategy that is more politically conservative and focusing on domestic issues is not anticipated to boost inflation nowhere near the 2 percent target. Enter the Bank of Japan again. With a slow inflationary growth scenario yet again, and the Federal Reserve not doing its part to lower the Japanese Yen by standing pat, the Bank of Japan is expected to increase the size of the stimulus package before the end of the year.

The BOJ is not expected to cut its 2 percent goal by more than 0.1 next week, which means that an intervention would be needed if the Japanese economy is ever to reach that in the allowed time frame. As a counter argument Finance Minister Taro Aso has said that easing alone won’t bring the economy near the target and that internal demand must pick up. Nomura amongst other banks expect the BOJ to increase its QE program but so far the government has been confident in the current levels of easing and the work of the central bank. That being said investors should be ready for another Halloween surprise as the Bank of Japan is due to release its statement.

JPY events to watch this week:

Thursday, October 29

Tentative JPY Monetary Policy Statement

Friday, October 30

2:00am JPY BOJ Outlook Report

Tentative JPY BOJ Press Conference

*All times EDT

For a complete list of scheduled events in the forex market visit the [MarketPulse Economic Calendar](http://www.marketpulse.com/economic-events/)

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.