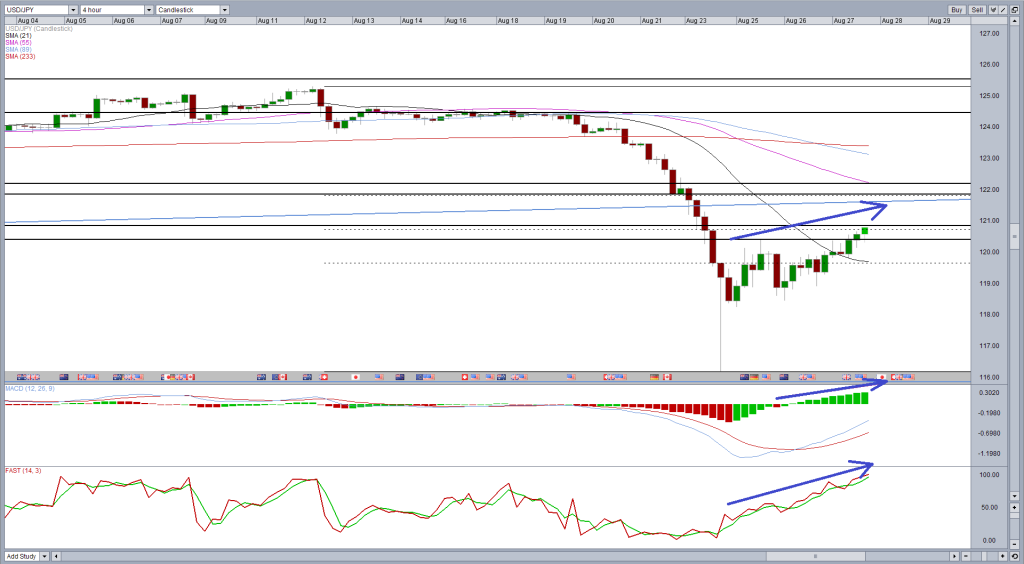

The dollar fell strongly against the yen at the end of last week and first trading day of this, with the latter benefiting from the unwinding of the currency trade and its perceived safe haven status.

The sell-off in the pair prompted a break below the ascending trend line – 16 January highs – and came close to its 2015 lows before rebounding.

The pair is about to test whether the sell-off was the beginning of a broader sell-off in the pair or just a one-off move sparked by market panic.

The pair is currently testing the 50% retracement of the move from 12 August highs to Monday’s lows which coincides with a prior area of support and resistance. If this sell-off is indeed part of a broader sell-off, this would represent a logical level for the pair to reverse back to the downside.

However, the rally over the last few days doesn’t appear to be losing any momentum at this stage, despite being held here for now.

With that in mind, we could see some further upside in the pair in the short term, which wouldn’t yet mean that the sell-off peaked on Monday.

The real test comes around 1.2180 where the ascending trend line – mentioned earlier – intersects a prior level of support and resistance and the 61.8% retracement of the previously mentioned swing high and low.

A failure to break through this level would effectively act as confirmation of the original break – a bearish signal – and suggest more downside pressures remain. We haven’t seen a significant correction in the pair for some time so it wouldn’t be surprising to see one now, even if the longer term outlook remains bullish.

Alternatively, a break and daily close above that resistance area would suggest the sell-off was just panic selling and the bullish bias remains in tact.

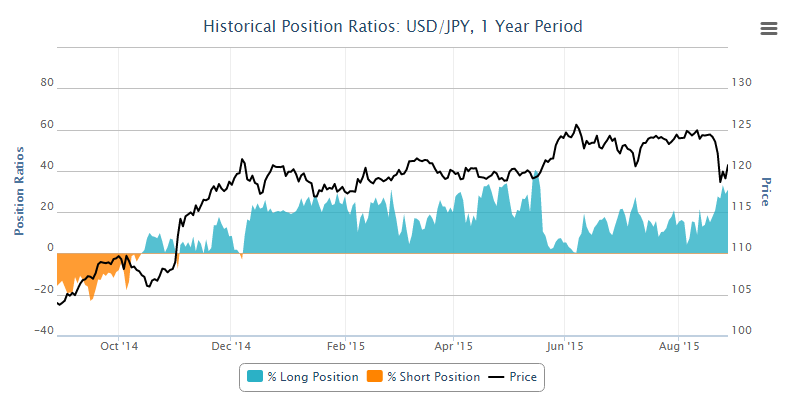

The above tools and others can be found in OANDA Forex Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.