After a very volatile and worrying start to the week for the markets, they finally appear to be finding their feet thanks in large part to the stimulus efforts from the People’s Bank of China and dovish comments from the Federal Reserve’s William Dudley.

Interest rate and reserve requirement ratio cuts and a stimulus injection of 140 billion Yuan from the PBOC over the last couple of days appears to have brought some stability back to the Chinese markets, which has been welcomed by investors globally. Black Monday created a lot of fear in the markets leaving the central bank with little option but to step in a stop the rout.

The fact that we’re seeing markets rebounding strongly today following a similarly strong rally in the U.S. on Wednesday suggests the fear is now passing. That said, sentiment is likely to remain fragile for a little while and more surges in volatility is likely to create more panic in the markets.

William Dudley, a voting member of the FOMC, played his part is shoring up sentiment on Wednesday, claiming that the case for a September rate hike is less compelling. This is something that many people had anticipated given the recent market turbulence and growing Chinese growth fears but the fact that it is being acknowledged by Fed policy makers is important. Until now, they have been willing to dismiss many things as transitory in their desire to raise rates this year. This suggests September is far less likely.

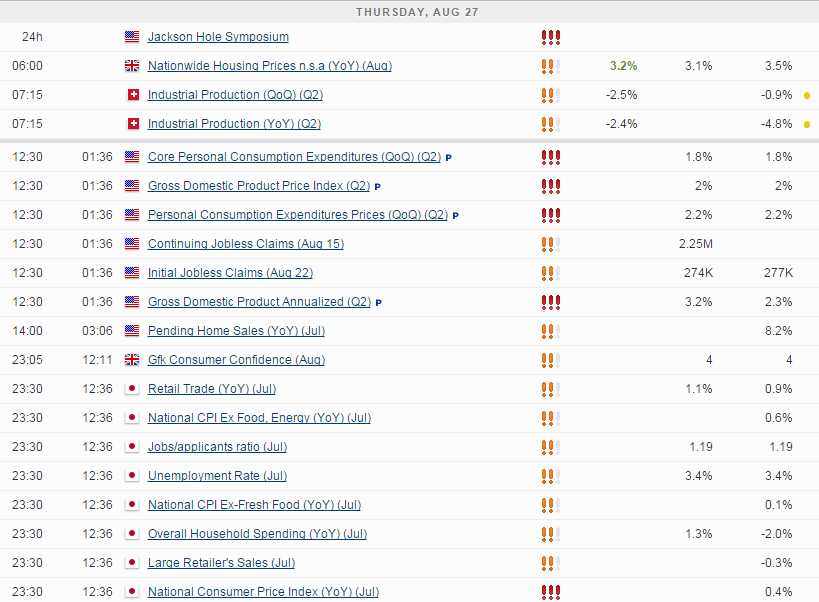

The Jackson Hole Symposium begins today so we could get the view of many more policy makers from the Fed, although only about half of them are expected to attend this year. That list doesn’t include Chair Janet Yellen who pulled out a few months ago. While this makes any strong indication of policy moves in the coming months unlikely – as we’ve seen at this event in the past, we could still get important insight from other policy makers including vice Chair Stanley Fischer who will speak on Saturday.

A strong batch of US economic data on Wednesday offered a reminder to investors that the economy is ticking along nicely. The first revision to second quarter GDP will be released today and is expected to show the annualized rate being revised higher from 2.3% to 3.2%, a much stronger rebound from the first quarter than was initially expected. This would clearly work in favour of those calling for a hike this year as it would suggest the economy is dealing with the impacts of the stronger dollar much better than has been suggested.

Jobless claims and pending home sales will also be released today, both of which are expected to offer a decent view of the economy. Pending home sales have been quite good this year although we did she an unexpected sharp decline last month that is likely to prove to be a one-off event. A 1% rise is expected for July.

The S&P is expected to open 24 points higher, the Dow 198 points higher and the Nasdaq 63 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.