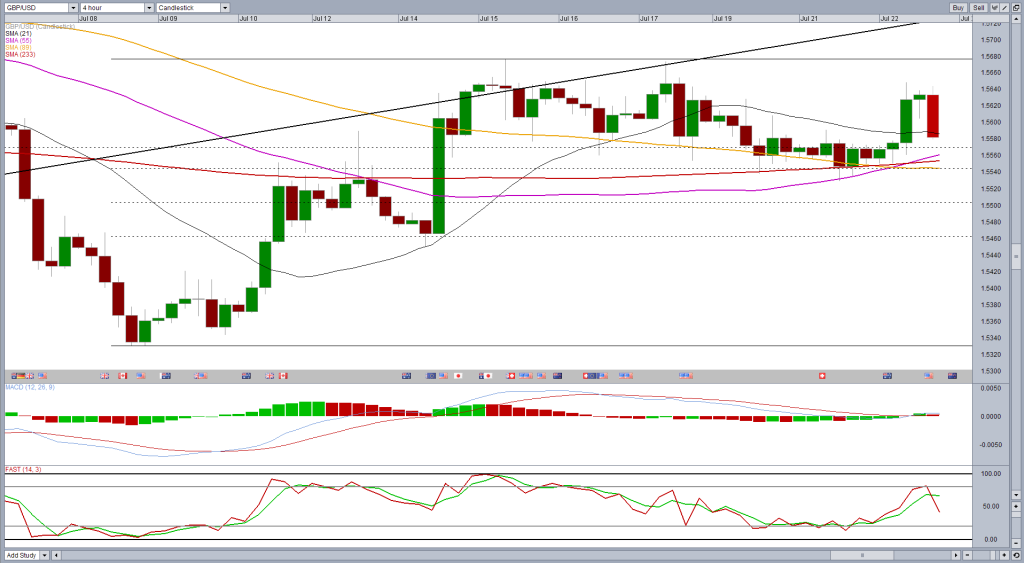

Cable is potentially looking quite bullish again after consolidating over the last week. The pair found support around 1.5530 from the 55 and 233-day simple moving averages and the 38.2 fib level – 8 July lows to 15 July highs – and now appears to be pushing on again.

If today’s candle closes above 1.5589, or around this level, it would create a morning star formation – very bullish setup – on a key support level. Of course, it should be noted that these formations are always stronger when the first and last candles are larger.

While the moving averages haven’t been great levels of support and resistance recently, they generally tend to be less effective during periods of consolidation, which we have seen as of late.

That said, the 55-day SMA has now crossed above the 233-day SMA which is a bullish signal and could trigger the next leg higher. Also, in recent sessions the two have offered strong support for the pair.

If the pair fails to hold above this support, further support could be found below around 1.55 – the 50% retracement of the above move.

A signal that this support may give way could come from the failure and the morning star to form on the daily while an evening star forms on the 4-hour. And a more convincing one at that with the first and last candles being larger.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.