With little data due on Friday investors will be zeroed in on the Greek crisis as talks between the cash-strapped country and its European creditors stagger toward a conclusion.

The collapse of talks again yesterday at the Eurogroup finance ministers’ level, and European Union leaders’ refusal to negotiate at the two-day summit underway today, means any deal before the weekend is extremely unlikely. The Greek impasse is overshadowing British Prime Minister David Cameron’s effort to renegotiate the U.K.’s membership in the E.U.

With another emergency Eurogroup meeting slated for Saturday morning, Sunday evening is earmarked as the final deadline for a deal to get done.

At issue is Athens’ refusal to accept economic reforms (austerity measures) in exchange for more aid, while its creditors aren’t willing to trust Greece’s ability to raise revenues via tax collection. It’s been said dodging the taxman is national sport in Greece.

In any event, and assuming no further delays, by the time the markets reopen next week, Greece will have either secured a bailout deal, or it will default on its €1.6 billion debt repayment owed to the International Monetary Fund (IMF).

Either scenario could prompt a significant reaction in the markets next Monday morning, especially a default, which can be very concerning from a trader’s perspective.

Bitter Talks Down to the Wire

Greece does not have the funds to pay the IMF, which means it needs to agree to on the terms of a bailout deal, and get it ratified in parliament in order for it to avoid defaulting. Be forewarned: the lack of a deal by Sunday could cause significant market distress.

With all this in mind, expect to see significant risk aversion this morning with investors preparing for fireworks over the weekend. The rhetoric coming from both camps over the last couple of days doesn’t make for nice reading, and many people will be preparing for a worse case scenario if both sides refuse to back down on key issues. This is an outcome many deemed unthinkable only a few months ago that has become a likely scenario as Greece nears the end of its second bailout with no access to further funding.

One of the great risks associated with this is that in the absence of a deal, the European Central Bank (ECB) could be forced to withdraw its emergency liquidity assistance (ELA) to Greek banks. That would force Athens to impose capital controls at home and possibly issue an alternative currency to the euro.

If the increasingly acrimonious negotiations do continue on Monday, it is possible that the ECB could refuse to raise the ceiling on its ELA loans. That would add significant pressure on the Greek government to get a deal done, and it would result still result in capital controls being instituted.

Expect Heighted Market Volatility

Needless to say, there is a lot of risk in the markets over this weekend. Experienced investors will likely and wisely opt for the risk-averse route today. There will be no lack of market volatility on Friday even in the absence of a deal or significant economic data being released.

Currency traders should also be wary of rumors today as these can cause significant turbulence in the markets. Officials will continue to work around the clock to try to find a way to get Greece to come to terms on a deal, and prevent it from being kicked out of the eurozone. To that end, German Chancellor Angela Merkel told reporters on Friday morning a deal must be agreed upon by Saturday.

Without a new agreement, eurozone officials will likely be left with little choice but to determine how they will manage the fallout of a Greek default.

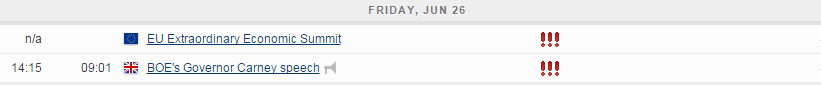

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.