Once again, all eyes will be on Greece on Monday and whether it can come to an agreement with its creditors and avoid a default and possible messy exit from the eurozone.

Greek Prime Minister Alexis Tsipras put forward new proposals on Sunday which he hopes will convince the institutions to release the €7.2 billion that was agreed back in February. It’s unlikely to be as simple as that, as it never is with Greece, but already the proposal has been labelled a “good basis for progress”, which offers some hope.

Negotiators from both sides have a lot to lose going into what could be the final day of negotiations. A large rally in Greece demanding Tsipras remain firm with the county’s credits sent another strong message that the public have had enough after years of painful austerity that has shrunk output by around a quarter and driven unemployment up to outrageous levels. Equally, German Chancellor Angela Merkel is under a lot of pressure not to bow to Greek demands and set a bad precedent for any other countries that run into financial difficulty. It seems unlikely that in the event of a deal, both sides will come out of this in good condition.

The main pressure on Greece to get a deal done isn’t necessarily coming from the International Monetary Fund repayment due in eight days as a default is extremely undesirable but not a complete disaster, it’s coming from what’s happening with the country’s banks. Withdrawals have ramped up significantly, with more the €4 billion being withdraw in the last week alone (compared to €200-300 million per day on average previously). Another €1 billion has apparently already been lined up for withdrawal for today as many people believe that Greek banks would close in the absence of a deal at today’s emergence EU summit.

The only reason Greek banks are still opening is because of the European Central Banks’ emergency liquidity assistance (ELA) program which has been providing banks with loans in exchange for collateral. The ECB can only continue to offer these loans as long as Greek banks remain solvent, something that will not be the case much longer if this pace of withdrawals continues. In fact, some would argue that the ECB has already overstepped the mark in an effort to try and buy time for a deal to be done, which is outside of its mandate.

On Friday, the ECB agreed to extend the funding to Greek banks until today, when it is due to have another teleconference to discuss it. If the ECB cuts off Greek banks, they would be forced to close while capital controls are put in place to prevent an even greater run on the banks than we’ve already seen. The chain of events that would follow could lead to Greece leaving the eurozone and re-introducing the Drachma. It truly is a massive day for Greece’s future. The time of hard negotiating is over, leaders from both sides need to strike a deal and avert disaster.

Investors appear to be at least a little optimistic that this can be achieved. Index futures are a little higher ahead of the open, while the euro has had a decent start to the week. While these talks do feel different to the past, what we have learned is that an 11th hour deal always follows weeks and months of discussions. We can only hope the same happens again today.

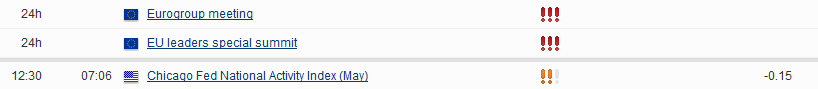

Aside from Greece, the day is looking rather quiet. There is no notable European data due out and the only U.S. release will be existing home sales. This leaves all eyes firmly on the negotiations and whatever comments we get throughout the day. I expect a lot of volatility in response to any comments or rumours that are likely to be coming thick and fast throughout the day.

The FTSE is expected to open 18 points higher, the CAC 16 points higher and the DAX 73 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.