European futures are expected to open lower again on Wednesday as indices look to extend losses to a fifth consecutive session on the back of Greek uncertainty and rising bond yields.

We are seeing some signs of stabilization in bond yields which may offer support to stock indices in the coming days. Bond market volatility is likely to continue to be a thorn in the side of the equity market for the foreseeable future as higher inflation expectations, low interest rates and low liquidity lead to occasional periods of excessive volatility. As European Central Bank President Mario Draghi warned, it’s just something we must get used to.

Greek uncertainty is still very apparent in the markets and is likely to continue to weigh on investor sentiment. There are signs of occasional progress but there is very much a case of two steps forwards and one step back about this process.

Greek Prime Minister Alexis Tsipras yesterday called on his Syriza party to rally behind the government as it tries to secure a cash-for-reforms deal that will enable it to avoid default at the end of the month. This alone was a rather bizarre rallying cry given the speech he gave to parliament on Friday in which he slammed creditor proposals as “absurd” which is hardly going to drive support for a deal.

The deadline for a deal – while not being specifically defined – is fast approaching. Greece needs cash by the end of the month to fund a €1.6 billion International Monetary Fund repayment and €1.5 billion in public sector wages and pensions. It is therefore generally believed that a deal will need to be agreed next week in order to pass it through the respective governments.

There was talk yesterday that another bailout extension could be agreed between the parties, extending Greek funding to March which I think will be most palatable for both sides. Neither parliaments will be keen to sign off on a third bailout for Greece and this would give Greece more time to gets its house in order again. That said, there still remains the task of agreeing on the terms of the extension which considering Greece has received no funds from the one agreed in February is by no means guaranteed.

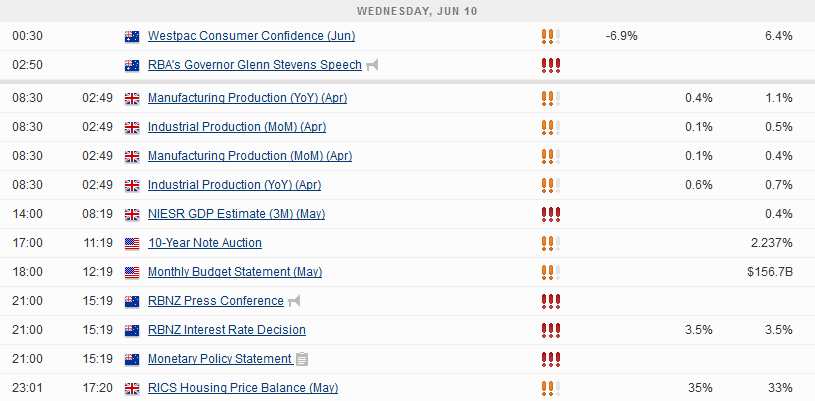

There will be a focus on the U.K. today as a number of pieces of data are due to be released. Manufacturing and industrial production figures for April are expected to show marginal improvements as exporters continue to face strong headwinds as a result of the stronger currency. The NIESR GDP estimate for the three months to May will be released this afternoon and should provide insight into how the economy performed in the first two months of the quarter. Last month’s 0.4% reading was disappointing but I do expect this to improve as the year progresses.

The FTSE is expected to open 9 points lower, the CAC 12 points lower and the DAX 3 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.