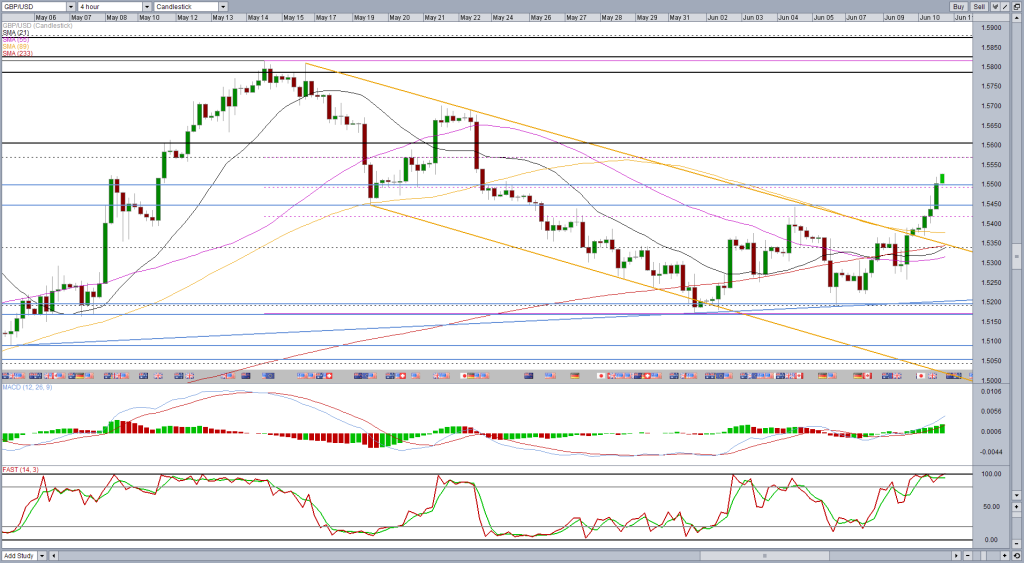

The breakout of the flag highlighted yesterday (GBPUSD – Breakout Near After Consolidation) has occurred and as you’d expect from this bullish continuation pattern, it has come to the upside.

The rally following the breakout has been quite strong, wasting no time whatsoever in breaking beyond last Thursday’s highs into a new uptrend (higher high completed after higher low on Friday). Another potential stumbling point would have been 1.55 – 50% retracement of the move from 14 May highs to 1 June lows – but the pair, despite slowing, appears to have broken this as well.

With these levels broken, I think we could see the 233-day simple moving average tested again, following the failed breakout attempt on 14 May.

The pair may face resistance along the way around 1.5570-1.56 – 61.8 fib level and previous support and resistance – but I’m not convinced that they will hold. I will be looking for signs of this though in the form of divergences and reversal set ups in price action.

If we see a correction, the pair could find support around 1.5450-1.55 as these are previous support and resistance levels.

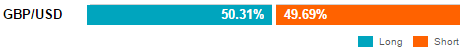

OANDA clients’ net position has tracked prices action quite well over the last month or so and once again they have become net long during the latest breakout. They have been slightly less bullish today though which may suggest that they do not believe the rally has legs.

*The above tools and many others can be found in OANDA Forex Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.