While there is still plenty to come this week, Thursday is shaping up to be a little more relaxed than yesterday as focus shifts solely to Greece and whether real progress can be made in bailout talks between it and the institutions of the European Union, European Central Bank and International Monetary Fund.

Talks have been moving at a snail’s pace in recent weeks which actually represents a big improvement on the first few months of the negotiations. Progress has been slow but at least we are seeing some. We may be clutching at straws now but it does seem that small amounts of progress are being made on a daily basis which does make me hopeful that a deal can be reached in the coming weeks.

The fact that we’re seeing negotiations on a daily basis between the most senior officials shows how much of a priority it has become. Yesterday evening, Grek Prime Minister Alexis Tsipras is believed to have held talks over the phone with German Chancellor Angela Merkel and French President Francois Hollande before having dinner with European Commission President Jean-Calude Juncker and Eurogroup Head Jeroen Dijsselbloem to discuss Greek and creditor proposals further.

While both sides remain in disagreement over some key issues, progress does seem to be being made. A smaller fiscal surplus target looks close to being agreed, which shows that Greece’s creditors are slowly but surely making concessions themselves. Debt forgiveness looks off the table for now, the key point going forward is how both sides will negotiate on pension and labour market reforms.

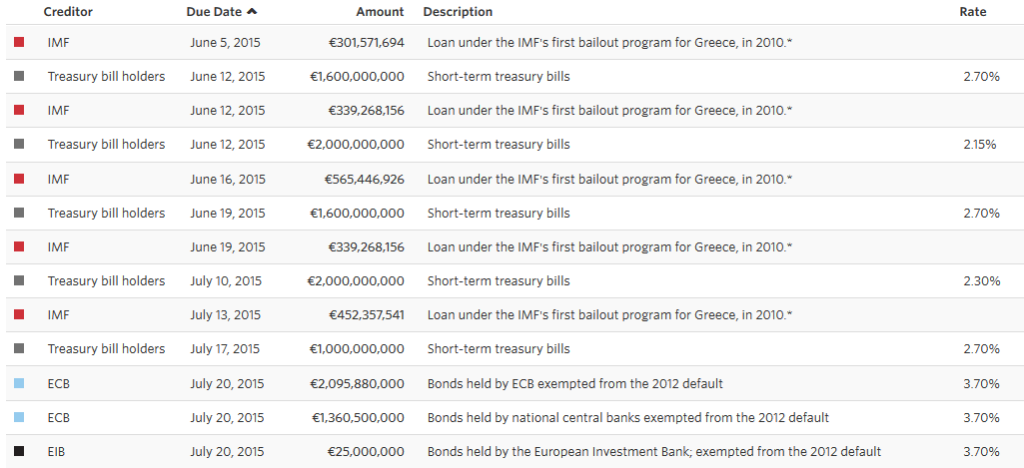

An agreement by Friday looks very unlikely but with Greece now apparently able to make its €300 million IMF repayment on Friday, the deadline for a deal to be done has been pushed back a little further. The chances are that we could now be looking at the end of the month when its current bailout expires, especially as the IMF appears open to waiting until then for the other €1.3 billion of repayments due in three parts this month.

*Greek June Repayments. Source – Wall Street Journal

Clearly there remains some way to go in talks so I refuse to get too optimistic. The messages coming from the talks are extremely mixed and even the creditors can’t agree on a consistent stance. Yesterday alone, Hollande and Spanish Economy Minister Luis de Guindos claimed a deal will be done before Friday while German Finance Minister Wolfgang Schaeuble and Dijsselbloem were far more pessimistic. I guess we should be taking all comments with a pinch of salt at the moment and just recognize that this is an improvement on the rhetoric coming from both camps prior to a couple of weeks ago. That alone is reason for optimism.

The Bank of England meeting today is unlikely to offer too much to these volatile markets today. Governor Mark Carney made it clear recently that the BoE is unlikely to raise interest rates until the middle of next year. While these forecasts are never set in stone, it would take something pretty extraordinary for the central bank to change its mind so dramatically this month.

The U.K. may appear on the path to a sustainable recovery but many things are still missing from it, most notably wage growth, productivity growth and balance. Moreover, the economy has been cooling and there are a number of headwinds facing it in the coming 12 months including fiscal tightening and a stronger pound, the effects of which the BoE will probably want to see before it begins raising rates.

The FTSE is expected to open 27 points lower, the CAC 22 points lower and the DAX 39 points lower.

For a look at all of today’s economic events, check out our economic calendar. www.marketpulse.com/economic-events/

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.