On this occasion, the 233-period simple moving average also weighed in to offer additional support around the 1.5230 level. The pair is now very close to the area that I highlighted previously (GBPUSD – Divergence Seen at Key Support) is looking like a key support region.

While I remain bearish in the long run, I think we could see some short term upside in the pair very soon. Given the descending channel that the pair now finds itself in, 1.5525 strikes me as a logical barrier to the upside, especially as it coincides with the 50 fib level – 14 May highs to today’s lows.

The pair may face initial resistance though around 1.5450 which has offered both support and resistance recently. This is also roughly the 38.2% retracement of the above move.

If we continue to grind to the downside then 1.5170-1.52 should offer further support as this is a prior support and resistance area and the 89-day SMA will also make it difficult. A change in momentum – and breaking of the divergence – may suggest a change has occurred at which point this level would not be as strong in my view.

As with all of these support levels, I would like to see a reversal setup on the daily chart to support the divergence, be that a hammer candle or something more convincing like a bullish engulfing pattern.

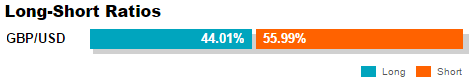

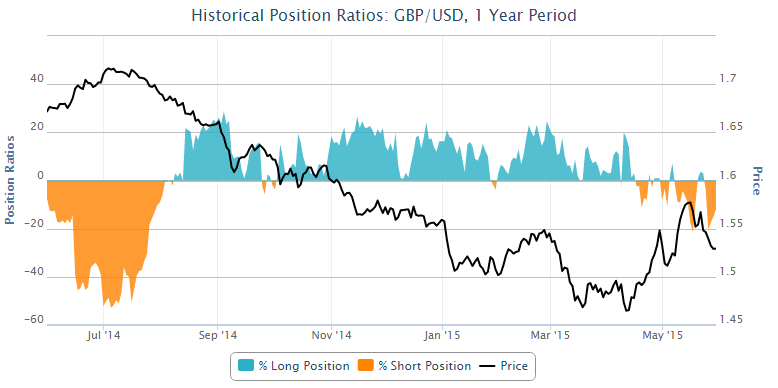

It should be noted that OANDA traders are becoming less bearish on this pair as momentum has been lost.

While historically the net position has been on the wrong side of the trade, which may support the bearish view, the net position has been on the right side of the trade over the last couple of weeks.

For access to OANDA position ratios, historical position rations and other trading tools, visit FX Labs.

For access to OANDA position ratios, historical position rations and other trading tools, visit FX Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.