There’s been months of negotiations between Greece and the institutions that have yielded very little but finally they appear to making some progress, which is helping to lift sentiment as we head into the end of the shortened trading week.

Of course, whether you believe progress has actually been made depends entirely on which officials you choose to listen to, which does confuse matters somewhat. While many people were skeptical yesterday when a Greek official claimed that creditors had started crafting a staff level accord, markets did respond very positively to the reports with stock markets surging shortly after the remarks. People became increasingly skeptical when the details of the agreement were released and appeared very favourably for Greece including debt relief, no wage or pension cuts and an investment package.

Nonetheless, markets only pulled back slightly at this stage and what was very interesting was that even when the deal was denied by E.U. officials, markets never really retreated. In fact they ended the day near session highs, although the pullback into the session close may highlight a slight unwillingness to expose themselves too much overnight. Even claims from German Finance Minister Wolfgang Schaeuble after the market close that they haven’t actually got much further in the negotiations don’t appear to have discouraged investors too much with futures only marginally lower.

I imagine this will be a very interesting end to the week in the markets with rumours of a Greek deal already flying around and likely to again before Friday’s close. Clearly investors believe there is some substance to those claims which is why gains were not reversed upon them being rejected by other officials. What’s probably likely is that progress has been made on the real sticking points, labour and pensions reforms, leaving only some minor details to be agreed. Of course, that is just speculation but clearly investors are more optimistic.

While we await further leaks from the negotiations, there’s some economic data being released today which will attract some interest. The U.K. kicks things off with its revised first quarter GDP release, which is expected to be increased slightly to 0.4%. While this still displays a slowing trend over the last year, I still believe it is encouraging and with further revisions to come it could be revised up again.

Spain’s first quarter GDP reading is also expected to be revised higher to a very impressive 0.9%, which will be a big boost to Spanish Prime Minister Mariano Rajoy and his People’s Party ahead of this year’s election, although it may have come a little late. A number of eurozone sentiment surveys for industrial and services sectors, consumers, business and overall economic sentiment will follow although these can attract less attentions as they come after the PMI figures which effectively tell us the same thing.

Over in the US we’ll get weekly jobless claims figures, pending home sales for April and the latest crude oil inventories data later, so even Greece aside this should be a very interesting session.

The FTSE is expected to open 2 points higher, the CAC 13 points lower and the DAX 10 points lower.

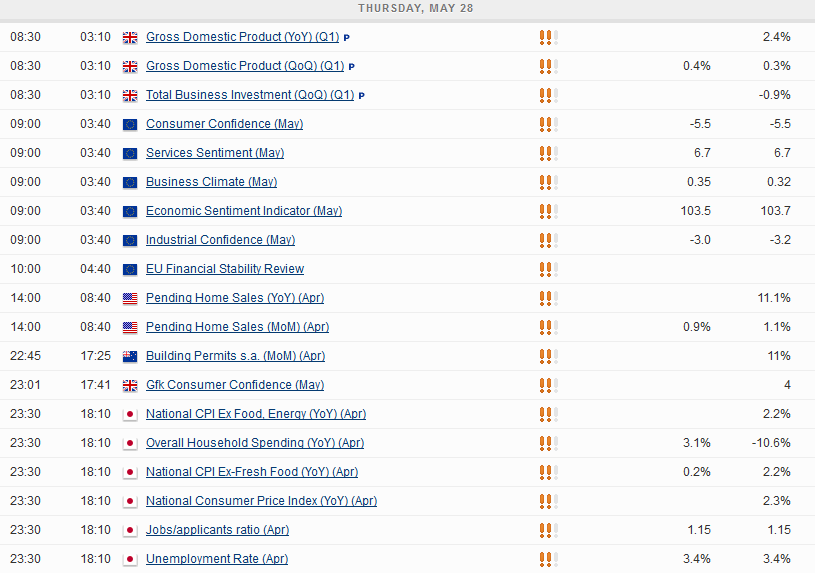

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.