European futures are pointing to a slightly higher open on Wednesday, paring losses from the start of the week on the back of big gains in government bond yields.

We did see yields pare some of those gains towards the end of Tuesday’s session which may be providing some relief to stocks ahead of the open. I think we’re reaching a point where investors are going to start seeing some opportunity in this sell-off in the bond market so at the very least, yields should begin to stabilize.

At the end of the day, investors are taking the opposite side of the trade to the ECB and winning, but that can’t carry on forever. There’s still another 16 months of bond buying to come. Of course, rates had to rise to reflect the higher inflation outlook as oil prices rise but I think the pace of the move has been exacerbated by a lack of liquidity.

Greece may have made its latest repayment to the IMF but that doesn’t appear to have eased any concerns about its ability to scrape together funds for future payments, or agree a deal with creditors that would unlock €7.2 billion in bailout funds. While we keep hearing about progress, the two parties still appear far apart of certain reforms on labour market and pensions and both seem unwilling to budge. Unless Greece backs down, I don’t see how a deal can be done. And if it does, they will probably put any deal to a referendum which would delay things even further.

The ECBs decision to increase emergency liquidity assistance to Greek banks yesterday by €1.1 billion to €80 billion in total suggests it’s not yet ready to significantly increase the pressure on the country. Hopefully this would suggest that progress is in fact being made in the negotiations because the ECB holds all the cards. The pressure can be ramped up enormously with absolute ease by the ECB whenever it sees fit. I don’t think this fact makes investors feel any more at ease because it means things could take a rapid turn for the worse at any point.

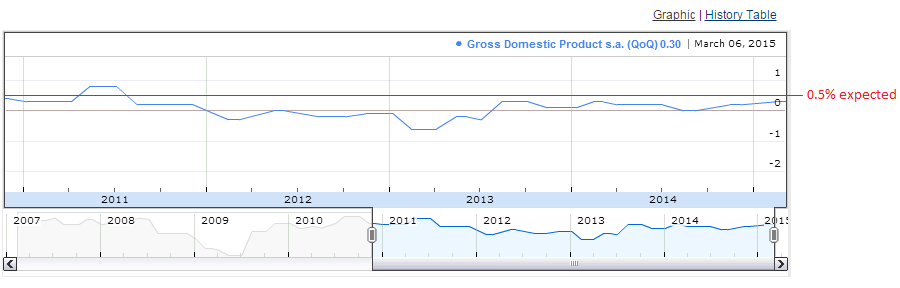

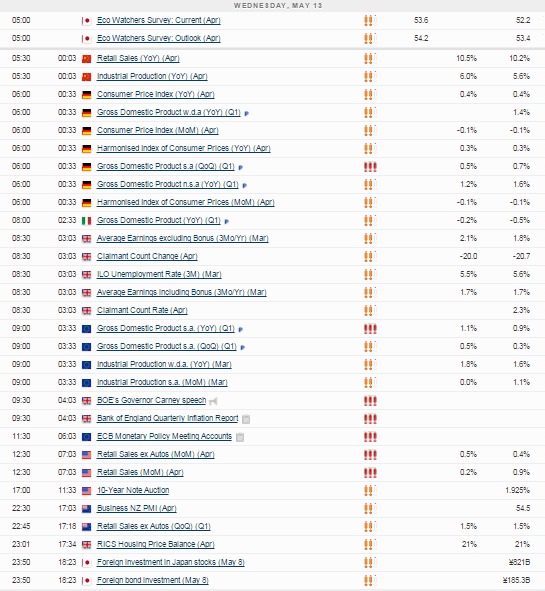

There’s a lot of economic data being released today which may offer a distraction from negotiations. Preliminary GDP readings from the euro area could offer some good news early on in the session. While the threat of a “Grexit” may be holding back the recovery, the eurozone economy is expected to have performed quite well in the first quarter, particularly by its own standards.

The eurozone is expected to have grown by 0.5% in the first quarter, its fastest rate of growth in four years, helped greatly by a significant depreciation in the euro and lower oil prices. Confidence is growing throughout the region and while Germany is a key contributor to that higher growth rate, the growth being seen a quite wide spread. All in all, I think people are finally becoming more optimistic on the eurozone.

There will also be a big focus on the UK this morning as we get the latest labour market data. Unemployment is expected to fall to 5.5% while average earnings, excluding bonus’, are expected to rise to 2.1%, well above current rates of inflation. Shortly after this, we’ll get the view on the economy from the Bank of England when Mark Carney delivers the latest inflation report.

Market interest rate hike expectations appear to have been widely pushed back to next year now, but with the economic recovery clearly on a strong footing and rising oil prices likely to provide a lift to the inflation outlook, I wonder if Carney may put later this year back on the table. It will also be interesting to hear the banks view on the election outcome and what impact this will have. Will the Conservatives pro-business stance and offer of an ongoing recovery offer greater chance of rate hike, or will further austerity likely damage the recovery in which case hikes will come later and be slower.

The FTSE is expected to open 16 points higher, the CAC 15 points higher and the DAX 47 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.