European futures are pointing to another negative start on Tuesday, as the global sell-off in bonds continues to weigh on equity markets and Greek reforms negotiations continue following failed talks by the eurogroup on Monday.

Finance ministers appear determined to get a more positive message across despite the absence of any deal, with Jeroen Dijsselbloem, eurogroup President, claiming talks were more efficient, more positive and more constructive. While this change of tone may be an encouraging sign, a deal on reforms still appears to be some way off still so the risk of a Greek default remains high.

One Greek official yesterday spoke of a transitional deal after Greece made its latest repayment to the International Monetary Fund a day early. This will likely involve Greece being able to raise more funds on the short term debt markets and enable negotiations to continue until the end of the four month deadline set in February. Unfortunately, this may mean another month of negotiations and uncertainty.

Another problem arises with the possibility of a referendum on any deal, despite Greek Finance Minister Yanis Varoufakis’ claim yesterday that it is not on the radar. Any deal is not likely to fall within the mandate that got the Syriza party elected which means it will either have to return home with its tail between its legs or put a deal to a referendum in order to get approval. Recent polls suggest Greeks want to remain in the eurozone so any referendum would likely be seen as a vote on eurozone membership.

The recent sell-off in bonds doesn’t appear to have been driven by Greek uncertainty, instead by changing inflation expectations as rising oil prices offers the prospect of higher inflation in the coming months. Large amounts of eurozone debt was yielding negative returns after the region fell into deflation territory and this had to reverse once we saw a rebound in oil prices. I think oil prices will begin to stabilise now though which could bring stability to other markets.

On the data front, focus will be on the U.K. with manufacturing output data for March being released and the first insight into growth in April coming from the NIESR GDP estimate for the last three months. George Osborne may use today’s Economic and Financial Affairs Council (ECOFIN) meeting to begin discussions on reforming Britain’s relationship with the E.U. having been given a full mandate by the electorate last week.

The FTSE is expected to open 15 points lower, the CAC 25 points lower and the DAX 109 points higher.

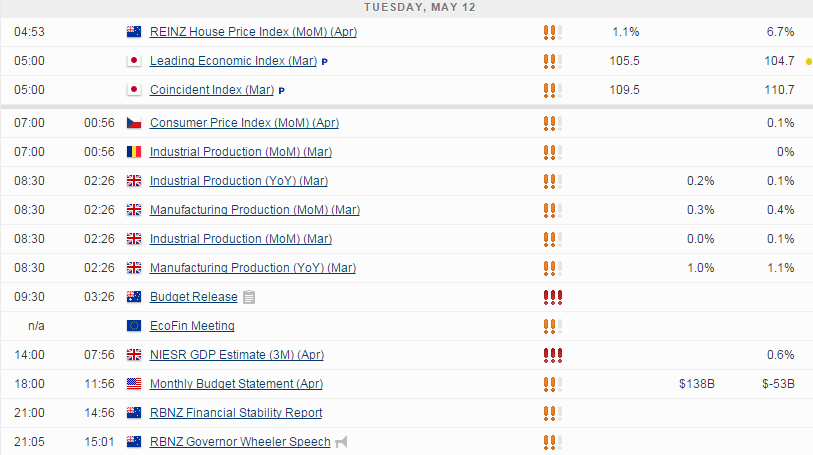

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.