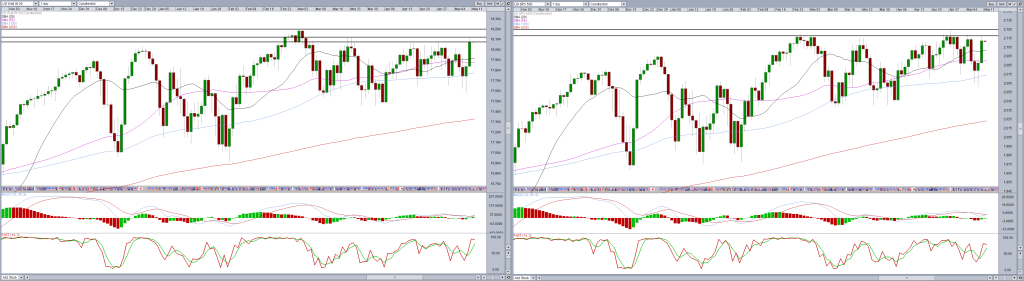

US futures are pointing to a slightly lower open on Monday following a big rally into the end of last week on the back of an encouraging April jobs report.

There’s probably a number of factors weighing on US futures this morning, one of which will simply be profit taking. The S&P is trading near all-time highs and there isn’t really any reason for these to be broken at this stage. The US has just been through a very difficult first quarter and the Fed is contemplating raising rates, neither of these are consistent with equity markets breaking into uncharted territory.

The US is also getting a negative lead from Europe, where Greece is currently locked in talks with its lenders as it tries to secure €7.2 billion in bailout funds and avoid defaulting on its debt. The message coming from officials in Greece and its creditors is that a deal won’t be done today and there’s no suggestion that it won’t be able to make tomorrow’s €763 million repayment to the IMF in the absence of a deal, so the saga goes on.

Negotiations barely appear to have progressed in recent months and that must be making investors nervous. Greek 2-year yields remain above 20% which tells you all you need to know about how confident the investing community is in Greece avoiding default. I don’t think we’ll see a messy Greek default although I do expect similar haircuts to be applied in the future as we saw previously. For now, we’ll probably have to put up with this back and forth for another couple of weeks at which point a deal will be agreed, and not one that Tsipras will be particularly pleased with.

Also weighing on European indices this morning is the further rise in government bond yields. Yields fell to incredibly low levels in Europe driven by the ECBs bond buying program and the deflationary environment that the region found itself in. With oil prices now rising on the back of slowing supply growth and weakening dollar, inflation is expected to return to the eurozone which is lifting yields.

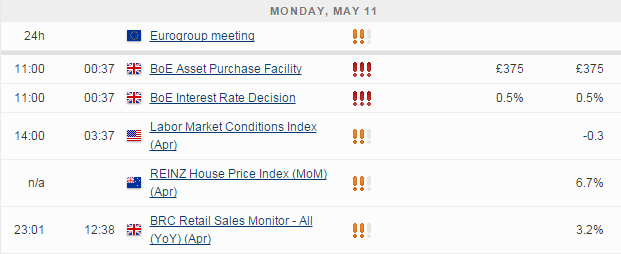

It’s going to be a relatively quiet start to the week in the US, with no big economic data being released. The only other notable economic event today is the latest Bank of England decision and even this is barely notable. The BoE is widely expected to keep rates and asset purchases on hold and with no statement likely alongside the decision, we’ll have to wait for the minutes to be released before we learn any more.

The People’s Bank of China has been far more active this year and continued this trend over the weekend when it cut both its lending and deposit rates by 0.25%. This prompted a 3% rally in China overnight but didn’t have a massive impact on other markets in a sign that investors were neither surprised nor overly pleased with the rate cut. I think the 1% cut in the reserve requirement ratio a couple of weeks ago may have suggested that any rate cut would be more aggressive. The rally in Chinese stocks was probably much greater because they suffered a more than 5% correction last week.

The S&P is expected to open 5 points lower, the Dow 33 points lower and the Nasdaq 7 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.