It has been an incredible day in the markets and the excitement is far from over as we await the release of the April US jobs report and people prepare for a weekend of uncertainty ahead of the eurogroup meeting on Monday.

The UK election has caught everyone off-guard as the polls showed the Conservatives and Labour neck and neck, the odds of a party achieving an overall majority were very slim. The return of the quiet Conservative rendered all of the pre-election polls useless, with the party now on the verge of commanding an overall majority in parliament.

I think this is the result the markets were hoping for as it offers the stability of a single party rule and is seen as the most business friendly outcome. Moreover, it offers continuity in a country that grew faster than the rest of the G7 last year and is expected to record strong growth again this year, second only to the US. The FTSE has benefited greatly from the Conservative greatly, as has the pound, rallying as high as 1.5522 against the dollar and a further rise to 1.58 could be on the cards.

Focus will now turn to the US jobs report, as investors looks for the signs of the strong recovery that would encourage the Fed to hike rates this year. It was a dismal first quarter for the US, driven by a rapid appreciation in the dollar, low oil prices and poor weather, but that is expected to improve in the coming quarters, as it did last year. The Fed itself recognized the poor performance in its latest statement but described it as transitory and hinted that rates will still rise this year.

A strong jobs report today, with at least 250,000 jobs being created in April, would support the view of the Fed and therefore a rate hike this year, possibly in September. Another poor number may point to a hangover from the first quarter performance which could push back rate hike expectations to late this year or early next. This is being viewed as a very important report and I think it will get a strong reaction in the markets.

If Wednesday’s ADP figure is anything to go by, we should prepare to be very disappointed, which could prompt further weakness in the dollar and strength in equities and US Treasuries, as this could mean rates staying lower for longer. It is worth noting though that the ADP does use lags of the office non-farm payrolls figure in an attempt to improve its methodology, so this would act as a drag on the number because of March’s measly 126,000 rise.

We also shouldn’t forget about the ongoing Greek negotiations which will continue over the weekend ahead of the eurogroup meeting on Monday. It can be quite unsettling when such important events take place over the weekend when the markets are closed. If negotiations collapse leading to a Greek default, or even if we get speculation that Greece will be allowed to default, we could see big gaps when the markets open on Monday. We saw it on numerous occasions throughout the debt crisis and it could happen again.

With that in mind, we may see some risk averse plays as we approach the close today. Any pull back in the euro, European equities or bonds would suggest that investors are not confident that a deal will be reached.

The S&P is expected to open 5 points higher, the Dow 57 points higher and the Nasdaq 19 points higher.

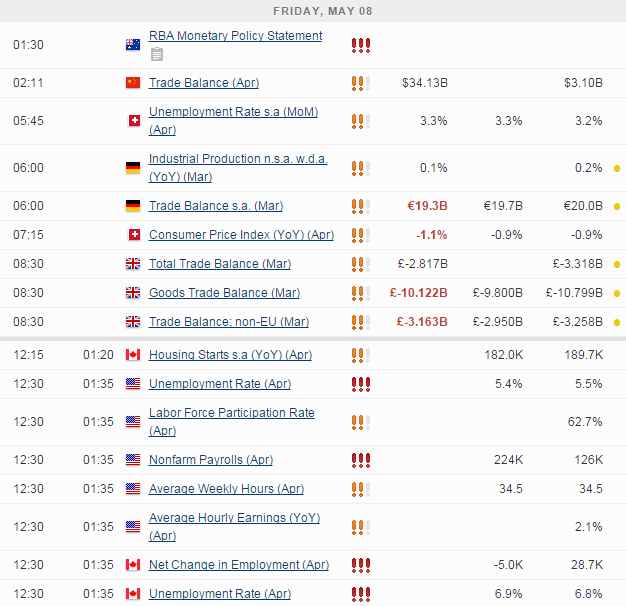

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.