Consolidation in the pair since Friday morning may suggest that the bulls are struggling to gain any momentum and once again, dollar strength will prevail. While that may be the case in the longer term, I think we could see some further upside moves in the short term.

The big test facing the pair at the moment is the 50-day simple moving average (SMA), which has capped any upside moves for almost a year, most recently last week. While on the previous couple of occasions, this has been met with strong selling pressure, on this occasion it appears to be holding its own, suggesting it may not be so simple this time around.

The 4-hour chart potentially support this view. The consolidation over the last 48 hours has led to the formation of a pennant, which is typically a continuation pattern. A break through the top of the pennant would suggest that a break of the 50-day SMA will follow as one of the benefits of these setups is that is offers potential price targets.

In this case, you take the size of the move on the approach to the pennant and project it above the breakout, which would take price well above the 50-day SMA. It would actually take us just beyond 1.11 which may suggest that a break above the recent trading range of 1.05 – 1.1050, although I would be quite cautious around 1.1050 as these projections aren’t always perfect.

It should also be noted that the 50-period SMA is in the process of crossing above the 200-period SMA on the 4-hour chart which is a sign of bullish momentum change. A break above the pennant and 50-day SMA could complete this and make the charts look increasingly bullish. Of course, the ultimate test of bias would come around 1.1050.

Helping to drive this move is reports today that Greek Prime Minister Alexis Tsipras has decided to shuffle his negotiating team working on the reform package with the country’s lenders. In effect, he has demoted Yanis Varoufakis who has been at loggerheads with eurozone finance ministers for months, culminating on Friday with them apparently completely losing their patience with him.

This is seen as a positive step for negotiations and already there is talk of Greece revising its reform list and suspending minimum-wage plans. A deal on reforms, which would secure €7.2 billion in bailout funds that Greece needs in order to avoid default, should support the euro which has been weighed down by all of the uncertainty in recent months.

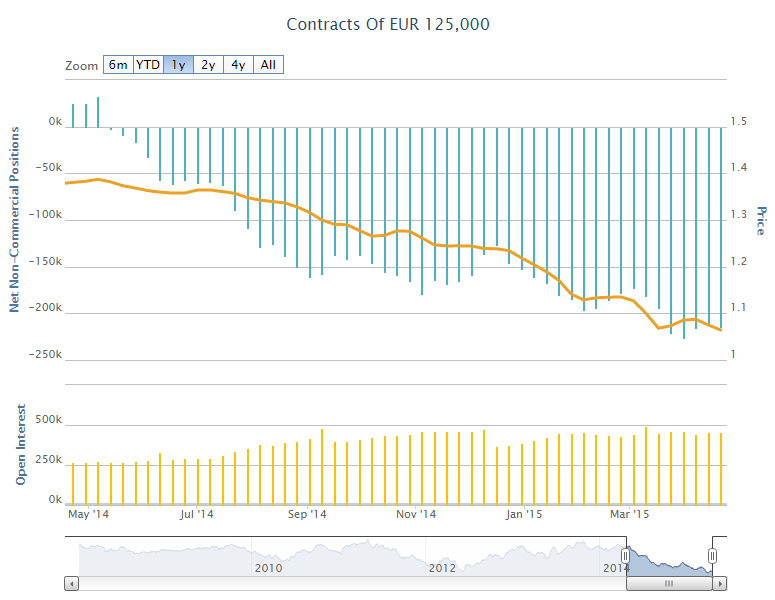

I should stress that a breakout is required for this to look more bullish and this is obviously not guaranteed. Last week the net non-commercial euro position became increasingly short, which would suggest the single currency is still under a lot of pressure.

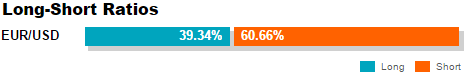

At the same time, OANDA clients have become slightly less net short in EURUSD today, with the book now being 60.66% short, down from 62.13% on Friday.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.